Data Science Project – Detect Credit Card Fraud with Machine Learning in R

FREE Online Courses: Dive into Knowledge for Free. Learn More!

This is the 3rd part of the R project series designed by DataFlair. Earlier we talked about Uber Data Analysis Project and today we will discuss the Credit Card Fraud Detection Project using Machine Learning and R concepts. In this R Project, we will learn how to perform detection of credit cards. We will go through the various algorithms like Decision Trees, Logistic Regression, Artificial Neural Networks and finally, Gradient Boosting Classifier. For carrying out the credit card fraud detection, we will make use of the Card Transactions dataset that contains a mix of fraud as well as non-fraudulent transactions.

Machine Learning Project – How to Detect Credit Card Fraud

The aim of this R project is to build a classifier that can detect credit card fraudulent transactions. We will use a variety of machine learning algorithms that will be able to discern fraudulent from non-fraudulent one. By the end of this machine learning project, you will learn how to implement machine learning algorithms to perform classification.

The dataset used in this project is available here – Fraud Detection Dataset

1. Importing the Datasets

We are importing the datasets that contain transactions made by credit cards-

Code:

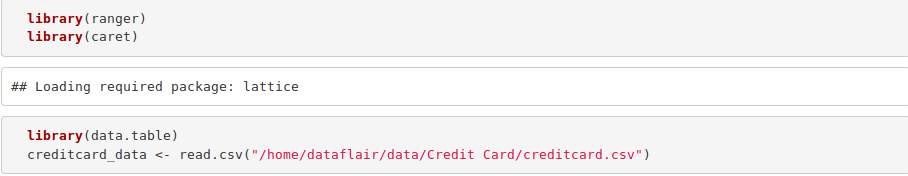

library(ranger)

library(caret)

library(data.table)

creditcard_data <- read.csv("/home/dataflair/data/Credit Card/creditcard.csv")Input Screenshot:

Before moving on, you must revise the concepts of R Dataframes

2. Data Exploration

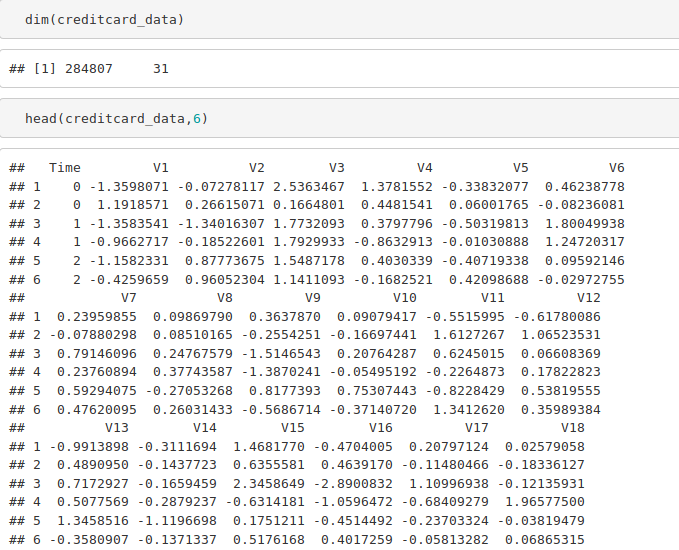

In this section of the fraud detection ML project, we will explore the data that is contained in the creditcard_data dataframe. We will proceed by displaying the creditcard_data using the head() function as well as the tail() function. We will then proceed to explore the other components of this dataframe –

Code:

dim(creditcard_data) head(creditcard_data,6)

Output Screenshot:

Code:

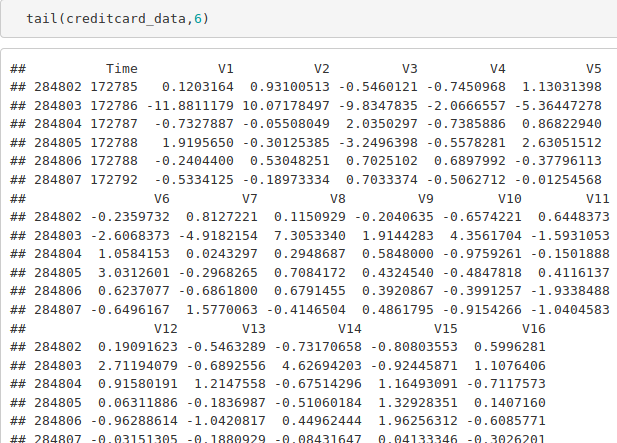

tail(creditcard_data,6)

Output Screenshot:

Code:

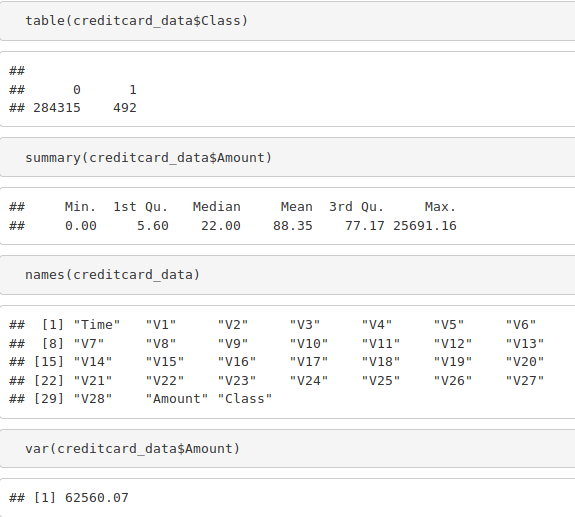

table(creditcard_data$Class) summary(creditcard_data$Amount) names(creditcard_data) var(creditcard_data$Amount)

Output Screenshot:

Code:

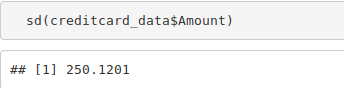

sd(creditcard_data$Amount)

Output Screenshot:

Learn everything about R for FREE and master the technology

3. Data Manipulation

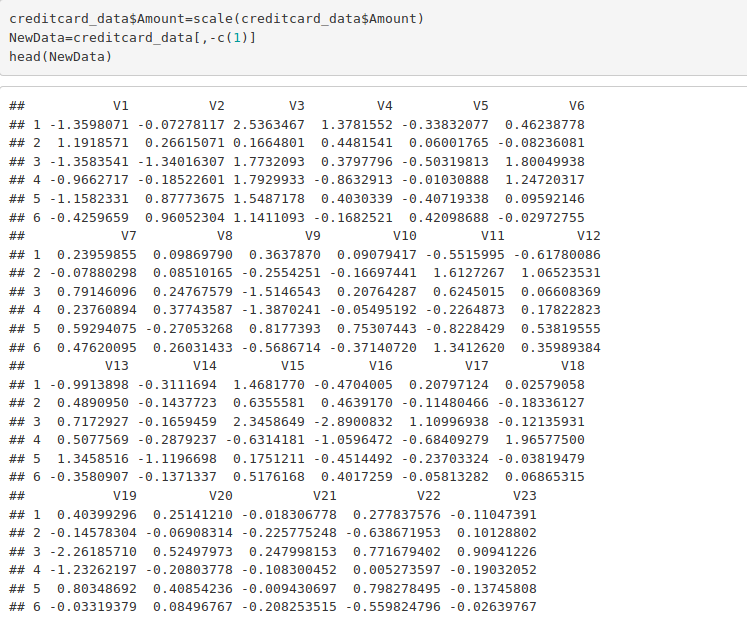

In this section of the R data science project, we will scale our data using the scale() function. We will apply this to the amount component of our creditcard_data amount. Scaling is also known as feature standardization. With the help of scaling, the data is structured according to a specified range. Therefore, there are no extreme values in our dataset that might interfere with the functioning of our model. We will carry this out as follows:

Code:

head(creditcard_data)

Output Screenshot:

Code:

creditcard_data$Amount=scale(creditcard_data$Amount) NewData=creditcard_data[,-c(1)] head(NewData)

Output Screenshot:

4. Data Modeling

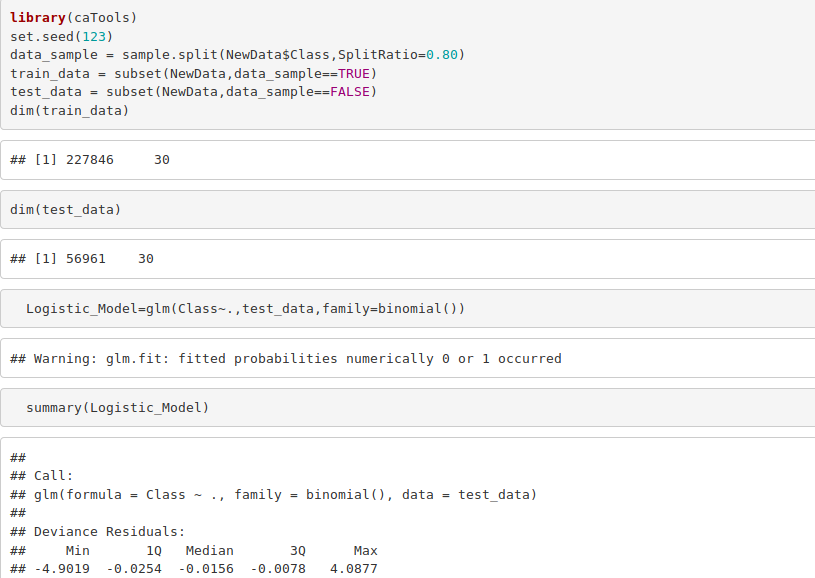

After we have standardized our entire dataset, we will split our dataset into training set as well as test set with a split ratio of 0.80. This means that 80% of our data will be attributed to the train_data whereas 20% will be attributed to the test data. We will then find the dimensions using the dim() function –

Code:

library(caTools) set.seed(123) data_sample = sample.split(NewData$Class,SplitRatio=0.80) train_data = subset(NewData,data_sample==TRUE) test_data = subset(NewData,data_sample==FALSE) dim(train_data) dim(test_data)

Output Screenshot:

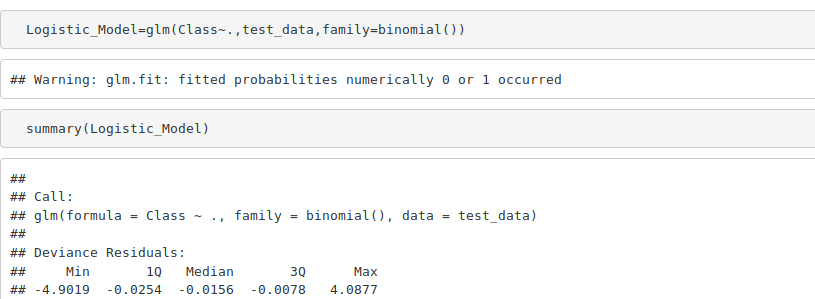

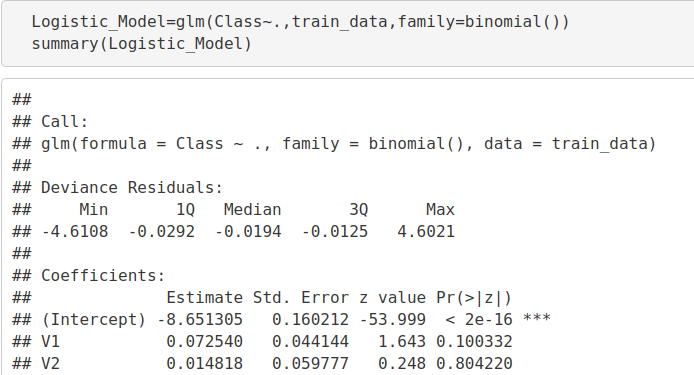

5. Fitting Logistic Regression Model

In this section of credit card fraud detection project, we will fit our first model. We will begin with logistic regression. A logistic regression is used for modeling the outcome probability of a class such as pass/fail, positive/negative and in our case – fraud/not fraud. We proceed to implement this model on our test data as follows –

Code:

Logistic_Model=glm(Class~.,test_data,family=binomial()) summary(Logistic_Model)

Output Screenshot:

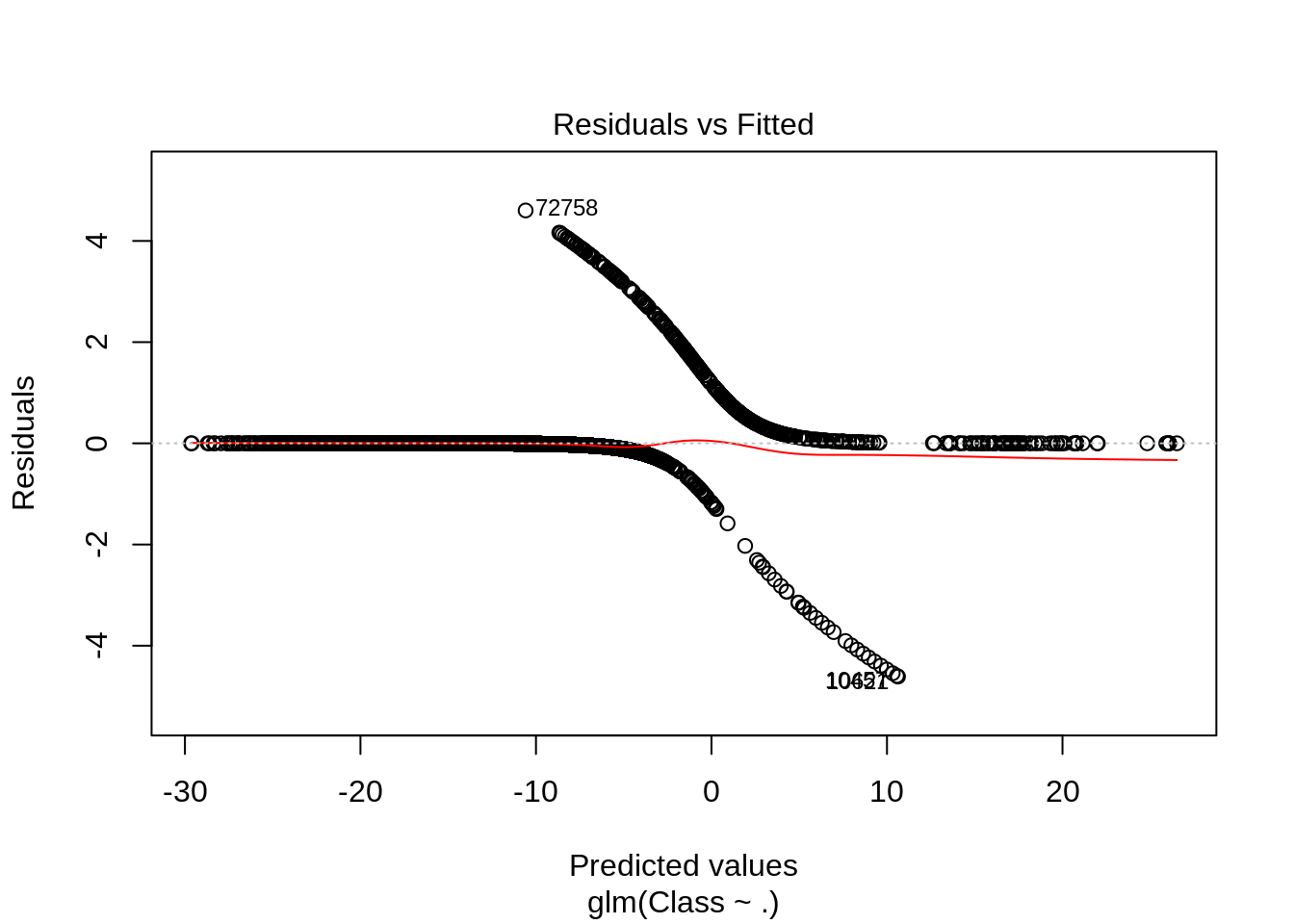

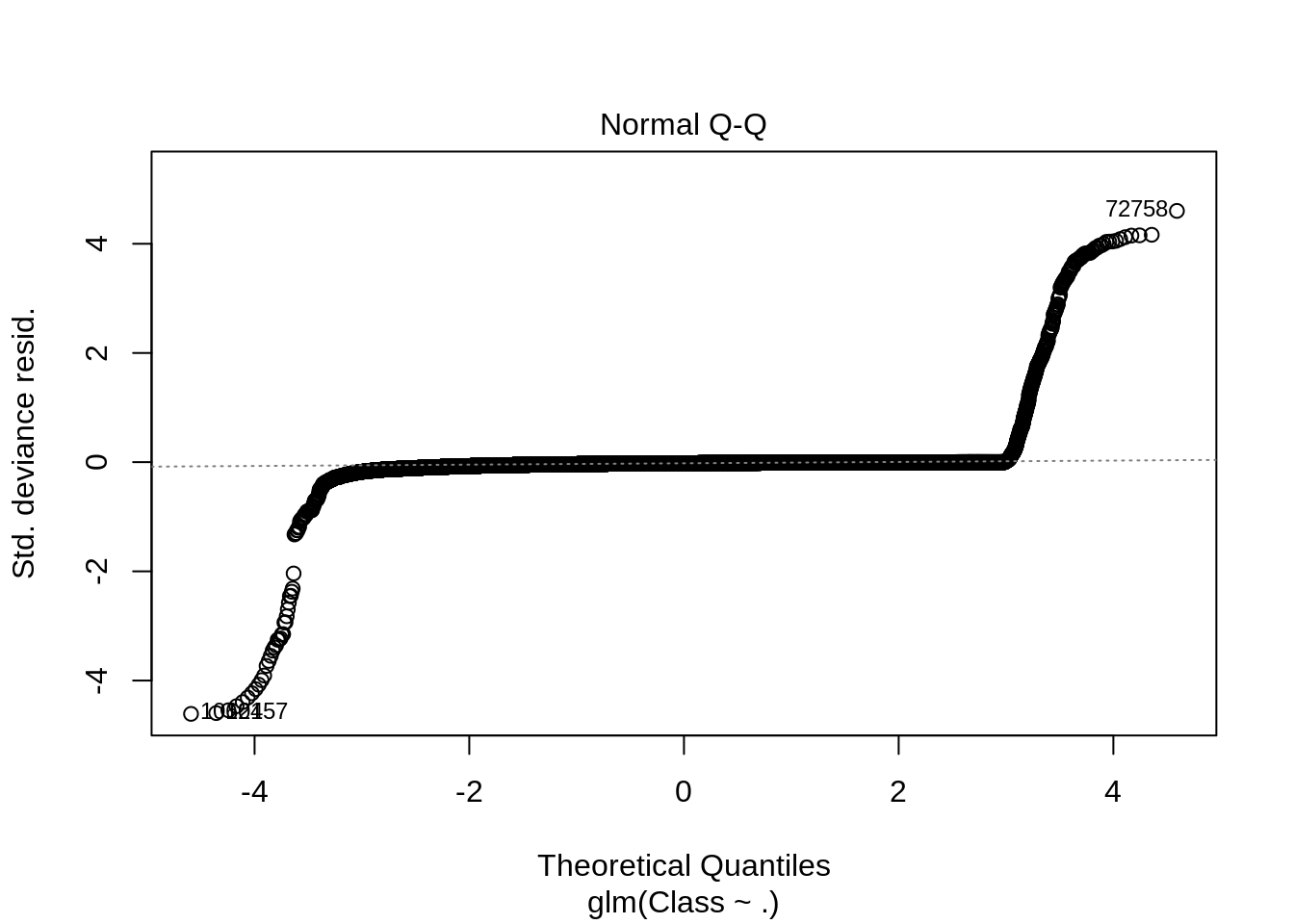

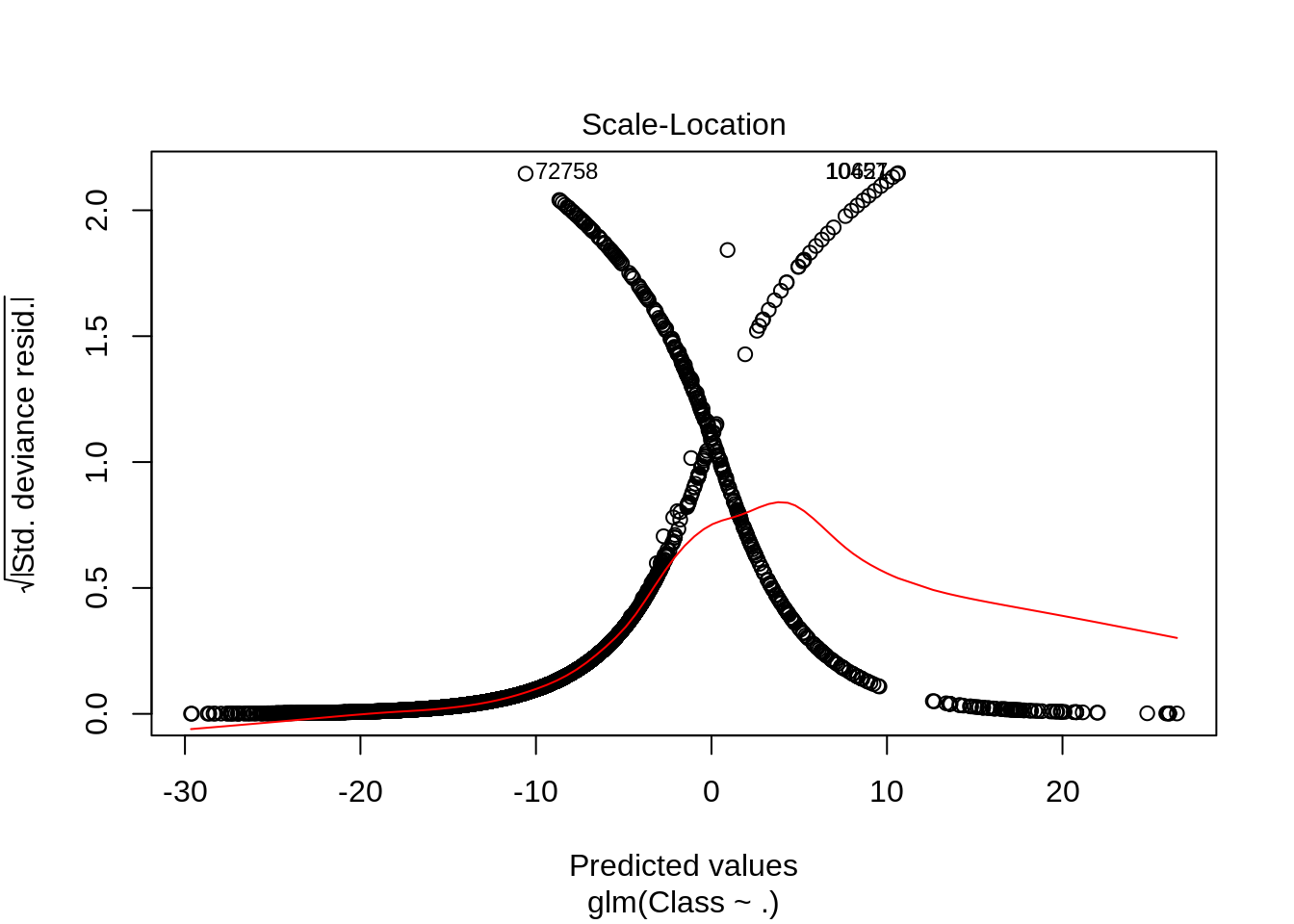

After we have summarised our model, we will visual it through the following plots –

Code:

plot(Logistic_Model)

Input Screenshot:

Output:

Output:

Output:

Output:

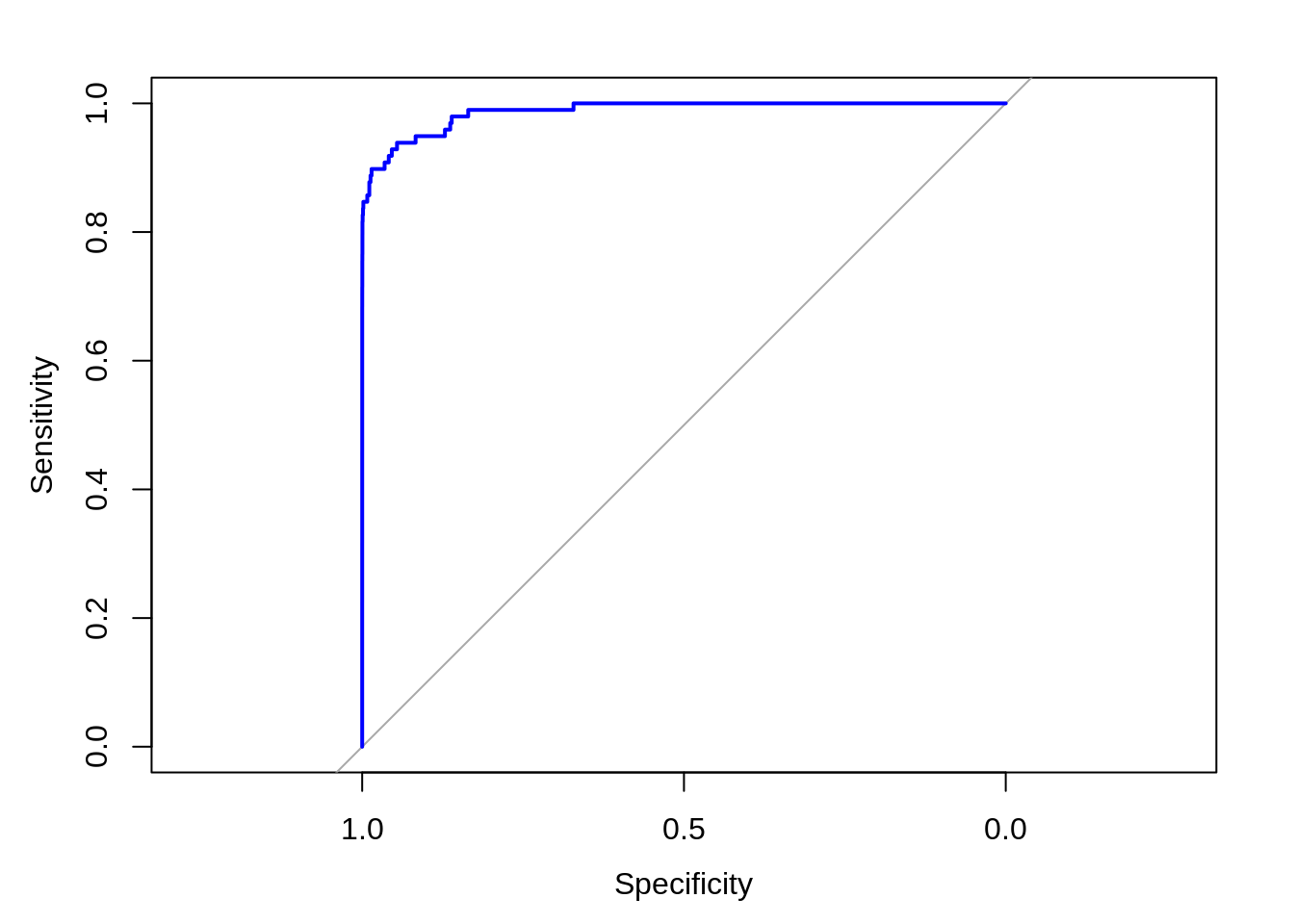

In order to assess the performance of our model, we will delineate the ROC curve. ROC is also known as Receiver Optimistic Characteristics. For this, we will first import the ROC package and then plot our ROC curve to analyze its performance.

Code:

library(pROC) lr.predict <- predict(Logistic_Model,train_data, probability = TRUE) auc.gbm = roc(test_data$Class, lr.predict, plot = TRUE, col = "blue")

Output Screenshot:

Output:

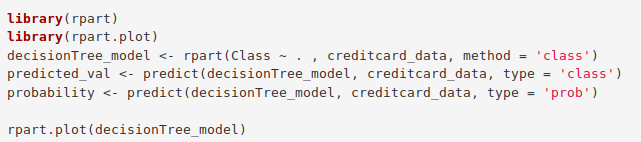

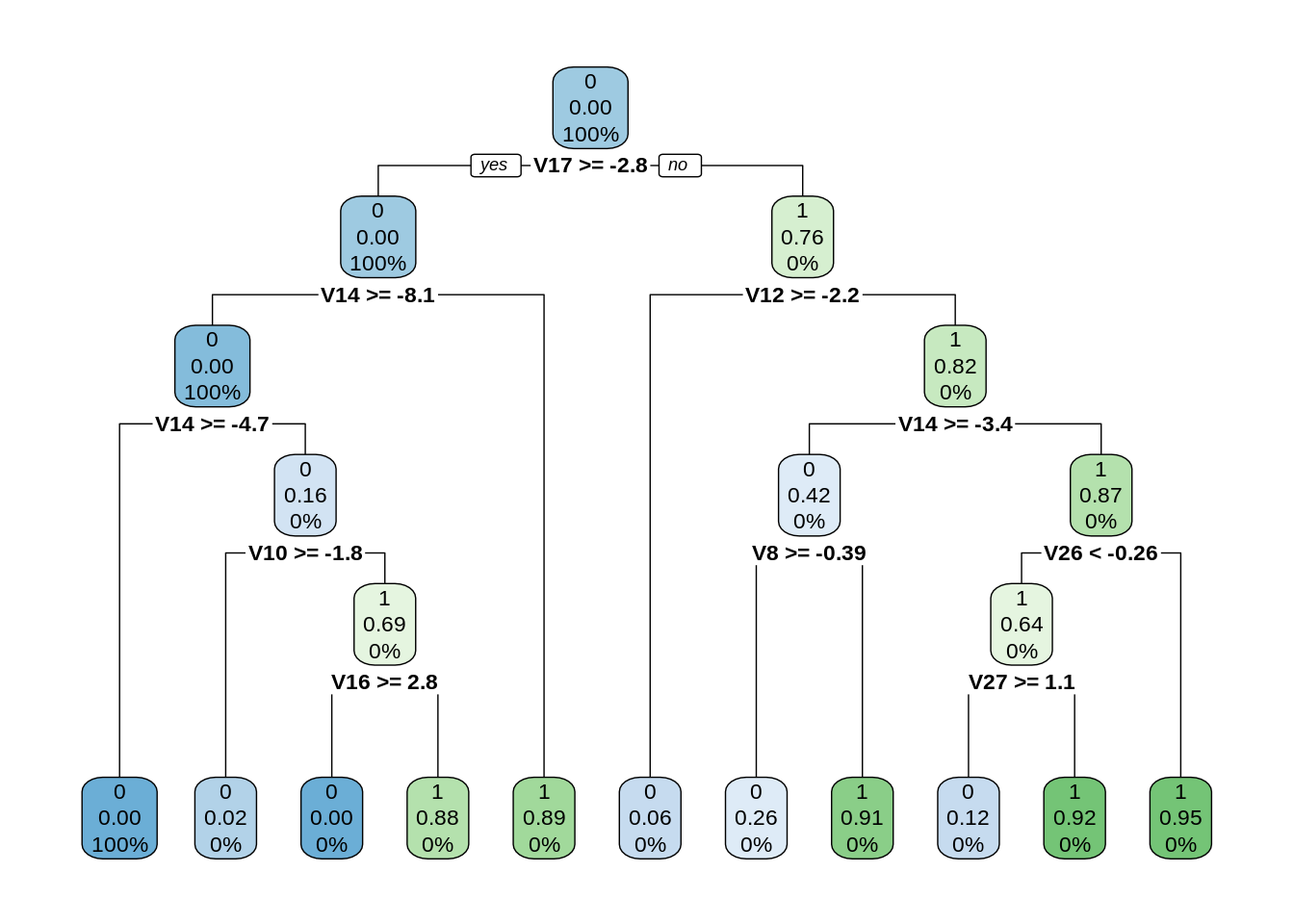

6. Fitting a Decision Tree Model

In this section, we will implement a decision tree algorithm. Decision Trees to plot the outcomes of a decision. These outcomes are basically a consequence through which we can conclude as to what class the object belongs to. We will now implement our decision tree model and will plot it using the rpart.plot() function. We will specifically use the recursive parting to plot the decision tree.

Code:

library(rpart) library(rpart.plot) decisionTree_model <- rpart(Class ~ . , creditcard_data, method = 'class') predicted_val <- predict(decisionTree_model, creditcard_data, type = 'class') probability <- predict(decisionTree_model, creditcard_data, type = 'prob') rpart.plot(decisionTree_model)

Input Screenshot:

Output:

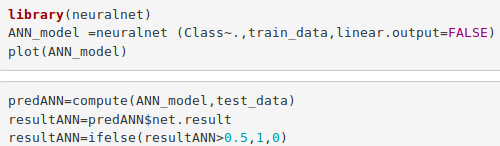

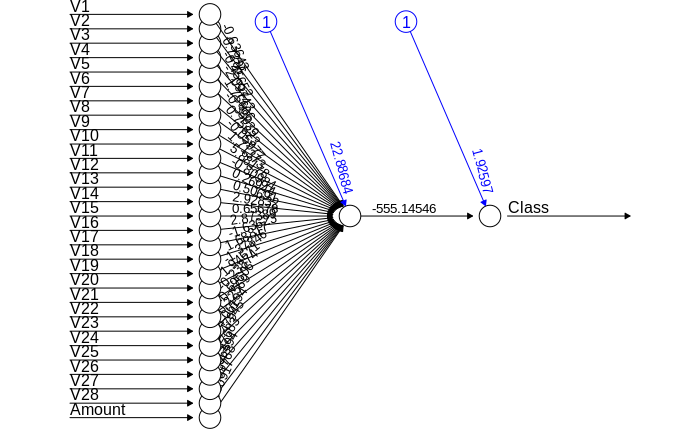

7. Artificial Neural Network

Artificial Neural Networks are a type of machine learning algorithm that are modeled after the human nervous system. The ANN models are able to learn the patterns using the historical data and are able to perform classification on the input data. We import the neuralnet package that would allow us to implement our ANNs. Then we proceeded to plot it using the plot() function. Now, in the case of Artificial Neural Networks, there is a range of values that is between 1 and 0. We set a threshold as 0.5, that is, values above 0.5 will correspond to 1 and the rest will be 0. We implement this as follows –

Code:

library(neuralnet) ANN_model =neuralnet (Class~.,train_data,linear.output=FALSE) plot(ANN_model) predANN=compute(ANN_model,test_data) resultANN=predANN$net.result resultANN=ifelse(resultANN>0.5,1,0)

Input Screenshot:

Output:

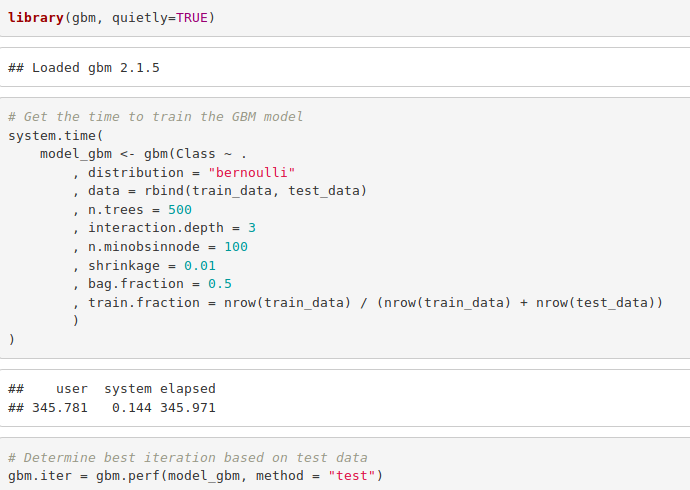

8. Gradient Boosting (GBM)

Gradient Boosting is a popular machine learning algorithm that is used to perform classification and regression tasks. This model comprises of several underlying ensemble models like weak decision trees. These decision trees combine together to form a strong model of gradient boosting. We will implement gradient descent algorithm in our model as follows –

Code:

library(gbm, quietly=TRUE)

# Get the time to train the GBM model

system.time(

model_gbm <- gbm(Class ~ .

, distribution = "bernoulli"

, data = rbind(train_data, test_data)

, n.trees = 500

, interaction.depth = 3

, n.minobsinnode = 100

, shrinkage = 0.01

, bag.fraction = 0.5

, train.fraction = nrow(train_data) / (nrow(train_data) + nrow(test_data))

)

)

# Determine best iteration based on test data

gbm.iter = gbm.perf(model_gbm, method = "test")

Input Screenshot:

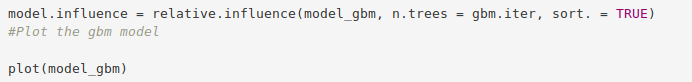

Code:

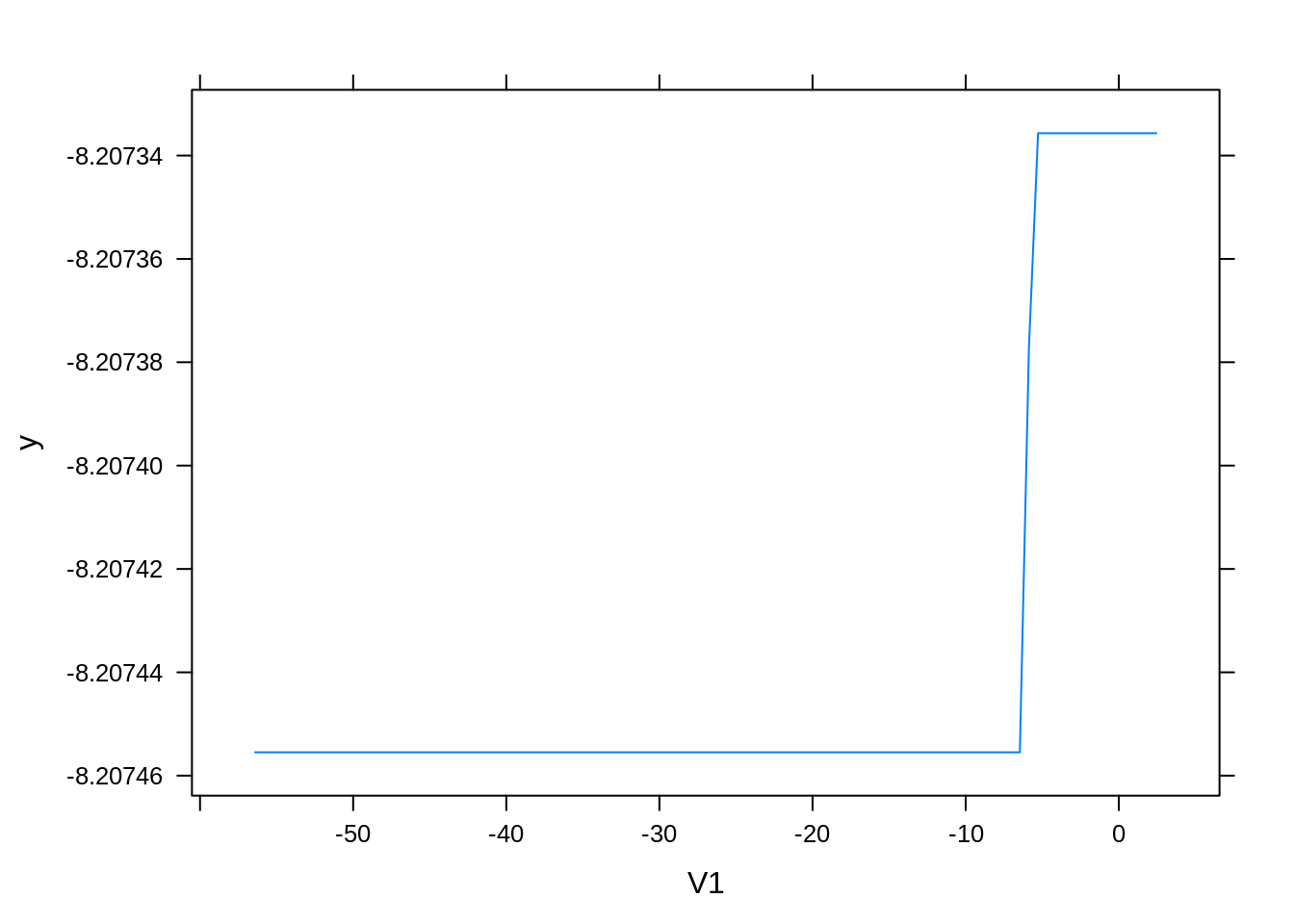

model.influence = relative.influence(model_gbm, n.trees = gbm.iter, sort. = TRUE) #Plot the gbm model plot(model_gbm)

Input Screenshot:

Output:

Output:

# Plot and calculate AUC on test data gbm_test = predict(model_gbm, newdata = test_data, n.trees = gbm.iter) gbm_auc = roc(test_data$Class, gbm_test, plot = TRUE, col = "red")

Output Screenshot:

Code:

print(gbm_auc)

Output Screenshot:

Summary

Concluding our R Data Science project, we learnt how to develop our credit card fraud detection model using machine learning. We used a variety of ML algorithms to implement this model and also plotted the respective performance curves for the models. We learnt how data can be analyzed and visualized to discern fraudulent transactions from other types of data.

So, now you are ready to detect the fraud. Machine Learning and R are the important technologies of this decade and will last forever. What are you waiting for? Start learning the machine learning concepts for FREE with the help of DataFlair’s Machine Learning Tutorial Series.

Hope you enjoyed the above R project. Share your experience and queries through comments.

Did you like our efforts? If Yes, please give DataFlair 5 Stars on Google

Good Project, a very good way to analyse

Hello, thanks for the great material! I have a doubt about the Logistic Regression model fitted,

wouldn´t this model be implemented on the training data? Because it has done on the test data.

Where can we download creditcard.csv?

You can download it from here – Fraud Detection Dataset

How can I pass few transactions to validate those are fraudulent or not.

What are V1 to V28 ?? please explain more clearly !!

All this is good. But I wonder how you derived values: V1 to V28 from the credit card transaction data.

Hi Nidhi,

The values v1 to v28 are the results of PCA dimension reductions to protect sensitive information like user identities.

i think that the logistic model must be predicted on the test set

# ROC_CURVE CODE :

library(pROC)

lr.predict <- predict(Logistic_Model,test_data, probability = TRUE)

auc.gbm = roc(test_data$Class, lr.predict, plot = TRUE, col = "blue")

Hope Data Flair clarify this!

Yes, you are absolutely correct. I encountered with the same issue.

Here I have done a corrected version

#Training Logistics Regression Model

Logistic_Model = glm(Class~., Train_data, family = binomial())

#Making predictions on Test_data

lr.predict <- predict(Logistic_Model, newdata = Test_data, type = "response")

#Computing AUC

library(pROC)

auc.gbm = roc(Test_data$Class, lr.predict, plot =TRUE, col ="blue")

Good project, can i get the paper for this project. ?

Hey Vinu,

Can you please explain your query more descriptively.

Can i get the row paper for this project (like ieee model)?

Thanks for a complete project. Every other steps you followed for completing a DS project. But your analysis for a certain steps are incomplete like you drew the ROC curve but did not explain your obersavation regarding ROC curve, why you need this techniqe why not anything else. Please clarify

Without using seed function how we predict the logistic regression model

can i get the whole source code file.

Hi Manideep,

The source code is present in the data science project itself. You can use it from there.

can you describe about the result obtained in the last code?please summarize according to the code

Hello Rose,

In the last section of the project, we calculate and plot an ROC curve measuring the sensitivity and specificity of the model. The print command plots the curve and calculates the area under the curve. The area of a ROC curve can be a test of the sensivity and accuracy of a model.

I hope this answer will help you.

Hi a pretty nice project though . will this project be enough as a final year project and can there be bit more better description on the graphs .

Very nice project,,,Awesome Explanation and Very Informative, Thanks for sharing this code

Hi! Very nice project. May I ask what is the original source of the data? or whether it is actually a real data?

Hey. It is a very nice project indeed. I was wondering if we can add a confusion matrix for each of the ML models and compare all the results in the end? Is it possible? If so can you help me with it?

hi I’m a student sorry for my english skil.

I wonder why I can not run this code in my computer

creditcard_data <- read.csv("/home/dataflair/data/Credit Card/creditcard.csv")

I'm already dowmload cvsfile and change directory but it dosen't work

Error in file(file, "rt") : cannot open the connection

In addition: Warning message:

In file(file, "rt") :

cannot open file '/home/dataflair/data/Credit Card/creditcard.csv': No such file or directory

could you please suggest me what to do thank you

Regardless of why you are getting the error:

1- initialize an R instance

2- use getwd() to find out your working directory

3- Download and copy “creditcard.csv” to your working directory

4- Use the command as follows: creditcard_data <- read.csv("creditcard.csv")

This should work.

Do remember to install the libraries that are initialized at the start.

Could you please elaborate the final outcome. Why did we do gbm. ?? By applying ANN and Logistic regression both do we have to identify the best fitted model also ? You have applied so many things but the purpose of all the algos and final outcome is not clear.

Nice Job,

But I think it would far better to interpret the output of each step! It is hard to follow when you have no idea about what you got!

Also as others mentioned above, in this code chunk:

“lr.predict <- predict(Logistic_Model,train_data, probability = TRUE)

auc.gbm = roc(test_data$Class, lr.predict, plot = TRUE, col = "blue")", please verify whether predict function should intake train_data as input or test_data? Using the code as it is would arise error because of difrent data dimentionality!

how can i fix it?

> auc.gbm = roc(test_data$Class, lr.predict, plot=TRUE, col =”blue”)

Setting levels: control = 0, case = 1

Error in roc.default(test_data$Class, lr.predict, plot = TRUE, col = “blue”) :

Response and predictor must be vectors of the same length.

What is the name of the tool needed to run this project??

This project is very good and knowledge base. One query is very questionable if we get proper usecase study/flow-chart with documentation. Really it is very helpful for interview purpose also.

Can u give a clear explanation about V1 to V28 ?

How many observations is it? and how many variables? Can you post the full rmd file please. thank you!

What are the pre requires imports and pacakages for this project?

i’ve got error, can you help me?

> auc.gbm = roc(test_data$Class, lr.predict, plot=TRUE, col =”blue”)

Setting levels: control = 0, case = 1

Error in roc.default(test_data$Class, lr.predict, plot = TRUE, col = “blue”) :

Response and predictor must be vectors of the same length.

I’ve got this error, can you help me?

> auc.gbm = roc(test_data$Class, lr.predict, plot=TRUE, col =”blue”)

Setting levels: control = 0, case = 1

Error in roc.default(test_data$Class, lr.predict, plot = TRUE, col = “blue”) :

Response and predictor must be vectors of the same length.

You have imbalanced classification problem so why did you split the data randomly? I know stratified sampling works better in that way to help maintain the distribution of the target variable. Also, there is a problem of data leakage when you standardize the variable “Amount” before splitting.

Yes, you are absolutely correct. I encountered with the same issue.

Here I have done a corrected version

#Training Logistics Regression Model

Logistic_Model = glm(Class~., Train_data, family = binomial())

#Making predictions on Test_data

lr.predict <- predict(Logistic_Model, newdata = Test_data, type = "response")

#Computing AUC

library(pROC)

auc.gbm = roc(Test_data$Class, lr.predict, plot =TRUE, col ="blue")

Also got the error by the corrected version.

“Setting levels: control = 0, case = 1

Error in roc.default(test$Class, lr.predict, plot = TRUE, col = “blue”) :

Predictor must be numeric or ordered.”

Never mind, problem fixed.

Never mind that the comment I post before. Problem was fixed. The corrected code worked.

Can you give some context about the data, what each column in the table means, because although your analysis is good it is meaningless because there is no significance in the data. Thanks for your reply.

Hi, I have a question for the plot(Logistic_Model). I followed your steps but got four plots with large scale. And I tried to add x-axis and y-axis limit, like plot(Logistic_Model, xlim=…, ylim=…), but I got error. How to adjust the scale of those plots and show the results like yours? Thank you.

I need project.