Machine Learning in Finance – 15 Applications for Data Science Aspirants

Free Machine Learning courses with 130+ real-time projects Start Now!!

Machine mints Money, Machine learns Money! Machine Learning splashes Magic in FINANCE.

Having money isn’t everything. Not having it is.

My strategy professor used to tell me that one should not concentrate all efforts and resources in just one area. If that area becomes weak then you tend to lose everything. She used to talk about this from a business perspective and therefore in a very early stage of life taught me how to ‘build lose bricks’ and ‘layers of advantage’.

The economics professor taught me to use my money wisely and taught me inflation (The Demand and Supply game). Conclusion: You should always have a substitute, different source or additional income (Plan B for money).

My Finance professor used to tell us that don’t put all your eggs in one basket. Take up your personal finance or business decision in such a way that you diversify the risk and gain maximum advantage.

Everything said here is important and should be applied but, is it possible to do it without the help of technology in this century? You must be smart enough to know the answer. With the reduced operational costs (thanks to process automation), the increased revenues and better productivity, the consumer experience is enhanced. How can I not mention the compliance and reinforced security facility? All I can do right now is to Thank Machine Learning.

With the advent of Machine Learning in Financial system, the enormous amounts of data can be stored, analyzed, calculated and interpreted without explicit programming.

Let’s talk Data!

Google says that: according to the survey of over 1,600 respondents, 61 percent, regardless of company size, indicated ML and AI as their companies’ most significant data initiative for next year. (Feb 7, 2018)

90+Free Machine Learning Tutorials – The Complete Toolset from Machine Learning Experts

How to Make Use of Machine Learning in Finance?

With unrealistic estimates and drains budgets, it is not enough to have a suitable software infrastructure in place (although that would be a good start). It takes a clear vision, technical knowledge and focus to deliver a valuable machine learning development project.

As soon as you get a good understanding of this technology it will help you to achieve business objectives and proceed with idea validation. This is a task for data scientists. They investigate the idea and thus help you formulate the viable KPIs and make realistic estimates.

Note: You need to have all the data collected at this point. If you don’t, then you would need a data engineer to collect and clean up this data.

Depending on a particular use case and business conditions, financial companies can follow different paths to adopt machine learning. Let’s get practical!

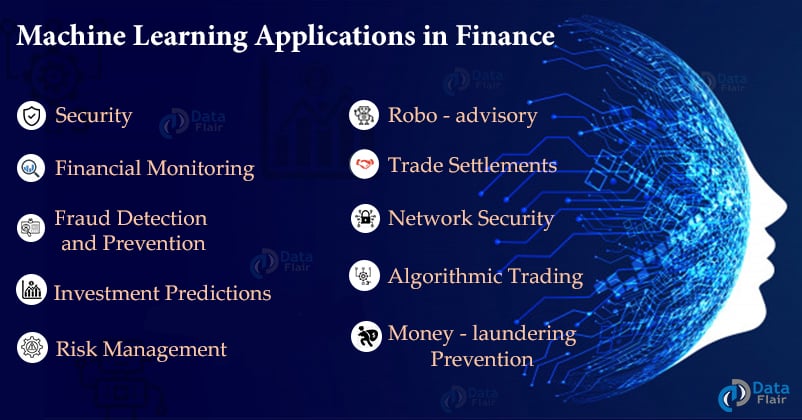

Machine Learning Applications in Finance

1. Security

The number of transactions, users, and third-party integrations and machine learning algorithms are excellent at detecting frauds.

Banks can use this technology to monitor thousands of transactions. Such model spots fraudulent behavior with high precision and identifies suspicious account behavior.

Machine learning algorithms need a split second to assess a transaction. The speed helps to prevent frauds in real-time, not just spot them after the crime has already been committed.

2. Financial Monitoring

Data scientists train system to detect a large number of micropayments and flag. Money laundering techniques as smurfing is one such case which can be prevented by financial monitoring. Machine learning algorithms can significantly enhance network security. There is a huge possibility that these technology power the most advanced cybersecurity networks in the near future.

Companies like Adyen, Payoneer, Paypal, Stripe, and Skrill are notable fintech companies. These companies invest heavily in security machine learning.

3. Fraud Detection and Prevention

Do you remember ‘Freedom 251’? It was a smartphone that was offered for sale in India at the promotional price of ₹251 by Ringing Bells Private Limited. Though it marketed itself as the world’s cheapest smartphone, later it turned out to be the opposite of what it promised.

The company planned to sell 5 million phones in June 2016. Because of major bookings, the website crashed. It took bookings for 30,000 at Rs 251 price. Needless to say more, but it was a fraud scheme that the company tried to do.

I am not saying that in future doing such frauds are not possible. But, with, machine learning, Fraud Detection Software war against financial fraud, can be curbed. Identifying and preventing such fraudulent transactions requires a sophisticated solution which can help in analyzing high-volume data. With machine learning, there is new hope. Patterns can be spotted and by using predictive analytics and applying machine learning algorithms such fraudulent transactions can be blocked.

WAIT! Do you want to become a Data Scientist?

Check out the 5 Real-world Data Science Projects with Source Code

4. Investment Predictions

Machine learning gives Advanced Market Insights. Using machine learning, the fund managers identify market changes earlier than possible with traditional investment models.

In no time, machine learning technology will disrupt the investment banking industry. Major institutions like JPMorgan, Bank of America, and Morgan Stanley have developed automated investment advisors. These are powered by machine learning technology. But, if you think that with investment prediction your risk will be minimized, then it is never happening. Someone has rightly said it that someone’s loss is someone’s gain.

5. Risk Management

Lehman Brothers Holdings Inc. was a global financial services firm. It was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch). Its operations were in the field of investment banking, equity and fixed-income sales and trading research, investment management, private equity, and private banking. But, the sad part is that its operations closed in 2008.

The reason for it getting collapse is that the global markets were hit and other banks were in precarious positions. They became heavily involved in the mortgage market and owed the subprime mortgage seller BNC Mortgage. The investor lost confidence in the bank. Thus the lack of risk management led to the subprime mortgage crisis.

Traditional software applications predicted creditworthiness based on static information from loan applications and financial reports. But, with machine learning technology it has increased its arena. Now, identification of the current market trends and even relevant news items can be done quickly.

With that, the risk management can be extended and it can help to prevent financial crime and financial crisis prediction.

6. Robo-advisory

Robo-advisors are now commonplace in the financial domain. In the advisory domain, there are two major applications of machine learning. They are:

- Portfolio management – It is an online wealth management service which uses algorithms and statistics to allocate, manage and optimize the clients’ assets. Here, users enter their present financial assets and goals. For example – if Mr. X saves a million dollars by the age of 50, then a Robo-advisor will allocate the current assets across investment opportunities based on his risk preferences and the desired goals.

- Recommendation of financial products – You don’t face a dilemma here, because many online insurance services use Robo-advisors to recommend you the personalized insurance plans. So, customers choose Robo-advisors over personal financial advisors to sort out the confusion. Robo-advisors can assist in lower fees, as well as personalized and calibrated recommendations are provided by them.

Don’t miss the Robotics and Artificial Intelligence Tutorial

7. Customer Service

The problem with the financial institutions is that they want to achieve the targets and therefore try to lead the customer in the wrong direction. To gain maximum profits, they sometimes try to exploit the customer. So with the help of virtual assistants, biases can be reduced. The only true picture will be shown to the prospective investors and they can get accurate information and fast solutions to their problems.

Chatbots: Robots that do the talking

Though chatbots existed before also, their effectiveness was not that great. Now, with machine learning, they are enabled to learn. They adapt their approach based on the behavior of each customer. Rather than simply following a prescribed set of instructions, they can help a user address his query just like a normal human being.

8. Loan Underwriting

Machine learning helps in identifying risks and set high premiums. With historical patterns and current trends, it is the perfect vehicle for insurance companies to improve profitability. Machine learning reduces underwriting risks.

This risk can be handled in any field related to money protection. Be it a loan, health, mortgage, or life insurance, machine learning can help manage every risk.

It also fits perfectly with the underwriting tasks that are so common in finance and insurance. Data scientists trained models on thousands of customer profiles with hundreds of data entries for each customer and perform underwriting and credit-scoring tasks in real-life environments. Such scoring engines help human employees work much faster and more accurately.

Any confusion in the Machine Learning for Finance article till now? Share your doubts in the comment section.

9. Trade Settlements

Trade settlement means the process of exchanging payment and completing the settlement. A number of issues can cause hindrance in trade settlement. But, machine learning makes sure that this is not the case and there is no Trade Fails.

With modern trading platforms, regulatory requirements have reduced. This has reduced trade failures. The controlling of inefficiency solved manually. Now, with machine learning, not only the cause of failure be known, but a solution for the same can be provided. That too within a fraction of a second. Even better, by identifying exceptions to normal trading patterns, ML can predict which trades are likely to fail.

10. Marketing

Marketing helps corporate finance and banking domain people. With Predictive Analytics in marketing, the ability to make predictions based on past behaviors has become easy.

Web activity can be properly monitored, mobile app usage can be understood to find trends and patterns. Also, the response to previous ad campaigns can be analyzed. With machine learning software, accurate predictions are made and the effectiveness of a marketing strategy enhances.

11. Network Security

Computer Virus, Worms, Trojan Horses, Zombies, and Botnets are the viruses existing for a long time. The major challenge was to identify modern sophisticated cyberattacks, as it cannot be relegated to yesterday’s security software.

With advanced technology, machine learning security solutions are capable of securing the world’s financial data. Power of intelligent pattern analysis, combined with big data capabilities, provides ML security technology an edge over traditional, non-AI tools.

Become a Big Data Expert by completing 170+ Big Data Tutorials by DataFlair

12. Algorithmic Trading

It is automated pre-programmed trading where instructions account for variables such as time, price, and volume send small slices of the order out to the market over time. With automation in the trading process, predefined criteria are set. This is done by the trader or the fund manager.

Machine Learning for Algorithmic Trading is more of an Intelligent Trading – It offers a new and diverse suite of tools to make algorithmic trading more than automatic.

They make trade predictions and are especially curated to analyze historical market behavior and determine an optimal market strategy.

13. Process Automation

With process automation, interpretation of documents has become effective. Also, data analysis can be effectively executed. It helps to execute intelligent responses to identify issues that will need human attention before they occur.

Machine learning also performs real-time audits of the institution’s processes, which makes regulatory compliance.

We know that automation replaces manual work and automate repetitive tasks. But, with the increase in productivity, machine learning enables companies to optimize costs, improve customer experiences, and scale-up services.

- Chatbots

- Call-center automation.

- Paperwork automation.

- Gamification of employee training, and more.

An example of this is JP Morgan Chase.

JP Morgan Chase helps to leverage Natural Language Processing. It is one of the machine learning techniques. Call-center processes legal documents and extracts essential data from them. The manual review of 12,000 annual commercial credit agreements would typically take up around 360,000 labor hours. But, with machine learning review of the same can be done in just a few hours.

Take a deep insight into Data Science guide on Natural Language Processing

14. Content Creation

Gone are the days where the content writers, artists, and other content creators have to stress their brains out (Creative people :P). With the advancement in Natural Language Processing (NLP) and machine learning, the machine is able to generate content.

Content written by financial institutions is repetitive. There is little need to create new content or add to the new one. Financial summaries( Balance sheet and P/l) company profiles, and even stock reports can easily be written by ML software. Time is money, Machine learning knows it better than humans.

15. Money-Laundering Prevention

Machine learning blocks money laundering activities. It is capable of identifying patterns that are unique to money laundering. This results in greater detection rates, fewer false positives, and easier regulatory compliance.

16. Custom Machine Learning Solutions

As financial institutions become more receptive to machine learning solutions, the question of where to acquire ML technology becomes a looming concern.

Summary

This brings to the end of our tutorial on machine learning in finance. We studied various use cases of machine learning in the finance sector along with examples.

It’s the turn for article on Machine Learning for Entrepreneurs

So, concluding it by the words of Warren buffet:

‘It is not necessary to do extraordinary things to get extraordinary results’

If you know any other machine learning application in finance, do tell us in the comments.

Your 15 seconds will encourage us to work even harder

Please share your happy experience on Google

This is a very informative and well written article.

Thanks for the appreciation. You can also check other Machine Learning concepts from the sidebar.

hi, actually i want to join Machine learning in Finance but I am not getting suitable class in mumbai will you help in this ?

Hey can you please provide link for the moneylaundring dataset