7 Breathtaking Applications of Data Science in Finance

Free Machine Learning courses with 130+ real-time projects Start Now!!

Finance has always been about data. As a matter of fact, data science and finance go hand in hand. Even before the term data science was coined, Finance was using it.

In this article, we will explore the latest applications of Data Science in Finance industry and how the advances in it are revolutionizing finance. We will also explore how various industries are using data science to manage their financial spendings.

Data Science in Finance

Data is everywhere. Industries perceive data as an essential commodity and fuel. It churns raw data into a meaningful product and uses it to draw insights for better functioning of the industry. Finance is the hub of data. Financial institutions were among the earliest users and pioneers of data analytics.

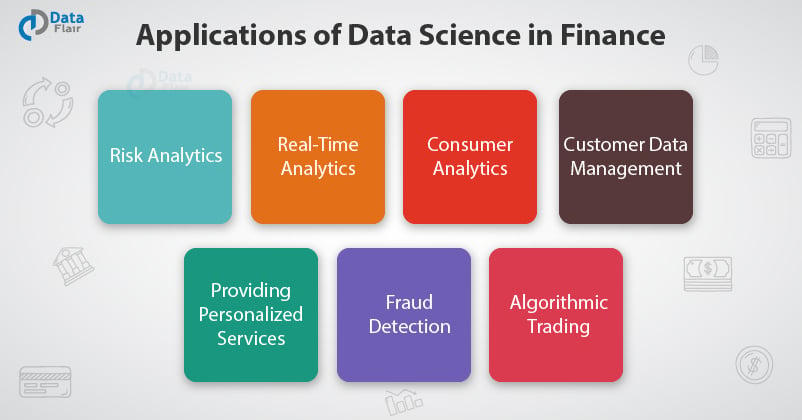

Data Science widely used in areas like risk analytics, customer management, fraud detection, and algorithmic trading. We will explore each of these areas and brief and give you amazing applications of Data Science in Finance Industry.

Application of Data Science in Finance Industries

1. Risk Analytics

Risk Analytics is one of the key areas of data science and business intelligence in finance. With Risk analytics and management, a company is able to take strategic decisions, increase trustworthiness and security of the company.

Since risk management measures the frequency of loss and multiplies it with the gravity of damage, data forms the core of it. Risk management is a cross-disciplinary field, it is essential to have knowledge of maths, statistics and problem-solving.

While traditional structured data could always be accommodated in spreadsheets, the more advanced form of data is not structured. This form of big data provides institutions with various opportunities.

There are various forms of risks that a company faces. These risks originate from competitors, credits, market, etc. The main steps towards managing risks are identifying it, monitoring and prioritizing the risks.

There is a huge availability of data like customer information, financial transaction. Therefore, the institutions train on this type of data to increase risk scoring models and optimize their costs. Another important aspect of risk management is to verify the creditworthiness of customers.

To analyze the creditworthiness, companies employ data scientists who use machine learning algorithms to analyze transactions made by the customers.

2. Real-Time Analytics

In traditional analytics, data processing was in the form of batches. That is, data processing that was only historical in nature and not real-time. This caused problems for various industries that required real-time data in order to gain insights into the present circumstances.

However, with the advancements in technologies and development of dynamic data pipelines, it is now possible to access the data with minimal latency.

With this application of Data Science in Finance, institutions are able to track transactions, credit scores and other financial attributes without any issue of latency.

3. Consumer Analytics

Consumer personalization is a major operation of financial institutions. With the help of real-time analytics, data scientists are able to take insights from consumer behavior and are able to take appropriate business decisions.

Financial institutions like insurance companies make use of consumer analytics to measure the customer lifetime value, increase their cross-sales as well as reduce the below zero customers for optimizing the losses.

Learn how can you become a Data Scientist with the help of an infographic.

4. Customer Data Management

Financial Institutions need data. As a matter of fact, big data has revolutionized the way in which financial institutions function. The volume and variety of data are contributed through social media and a large number of transactions.

The data is present in two forms-

- Structured data

- Unstructured data

While the structured data is easier to handle, it is the unstructured data that causes a lot of problems. This unstructured data can be handled with several NoSQL tools and can be processed with the help of MapReduce.

Business Intelligence is the most important aspect of Big Data.

Industries utilize machine learning to generate insights about the customers and extract business intelligence There are various tools in Artificial Intelligence like Natural Language Processing, data mining and text analytics that generate meaningful insights from the data.

Furthermore, machine learning algorithms analyze the financial trends and changes in the market values through a thorough analysis of the customer data.

5. Providing Personalized Services

Financial Institutions are responsible for providing personalized services to their customers. Financial Institutions employ a variety of techniques to analyze customer information and generate insights about their interactions.

Furthermore, financial institutions are relying on speech recognition and natural language processing based software to provide better interactivity to its users.

With the data that is provided back by the users, financial institutions are able to take actionable insights of their customer needs which would lead to an increase in profit. This would help the institutes to optimize their strategies and provide better services to their customers.

6. Fraud Detection

Fraud is a major concern for financial institutions. The dangers of fraud have increased with an increase in the number of transactions. However, with the growth in big data and analytical tools, it is now possible for financial institutions to keep track of frauds.

One of the most widely practiced frauds in financial institutions is credit card fraud. The detection of this type of fraud is due to the improvements in algorithms that have increased the accuracies for anomaly detection.

Furthermore, these detections alert the companies about anomalies in financial purchases, prompting them to block the account so as to minimize the losses.

Various machine learning tools can also identify unusual patterns in trading data and alert the financial institutions for further investigation into it.

There are other insurance-related frauds that banks have to deal with. Using several clustering algorithms, companies are able to segregate and cluster patterns of data that seems to be highly suspicious.

7. Algorithmic Trading

Algorithmic Trading is the most important part of financial institutions. In algorithmic trading, there are complex mathematical formulas and lightning speed computations that help the financial companies to devise new trading strategies.

Big Data has had a huge impact on algorithmic trading and data science has become its most important feature.

The data present in the algorithmic trading consists of massive data streams and involves a model that measures and describes the underlying data streams. The aim of the analytical engine is to make predictions for the future market by having a better understanding of the massive datasets.

Get the Best Big Data Training to Boost your Career

Summary

In the end, we conclude that there are many roles of Data Science in Finance sector. The use of Data Science is mostly in the field of Risk Management and analysis. Companies also use Data Science customer portfolio management for analyzing trends in data through business intelligence tools.

Financial companies use data science for fraud detection to find anomalous transactions and insurance scams. Data Science is also being utilized in algorithmic trading where machine learning plays a pivotal role in making predictions about the future market.

Hope, you liked our explanation. You can express your feedback related to Data science in Finance in the comment section.

You give me 15 seconds I promise you best tutorials

Please share your happy experience on Google

data anyasis of data revalution but there