5 Ultimate Reasons You Should Trust AI in Online Banking

Free Machine Learning courses with 130+ real-time projects Start Now!!

AI in Online Banking

Artificial intelligence has already made waves in every market that dips its toes into the technology, in spite of any resistance and hesitation felt by some constituents within them.

But why are people resisting artificial intelligence and what can it do for the online banking industry? Let’s explore these two questions.

Meet the AI Resistance

The financial services industry is no different than other industries in terms of AI resistance, with some critics and industry professionals placing emphasis on the human experience and emotional aspects of the services they offer.

They claim that consumer facing financial services are best doled out by experienced advisors with a keen sense of what their customers are looking for.

And many customers are also faithful members of the AI resistance. According to a survey facilitated by GfK, 45% of respondents claim they aren’t willing to give up live customer service to pay less in fees.

Beyond customer service, the real meat and potatoes of AI technology is in its specialized algorithms which is an another aspect of AI that is hard to trust and adapt for consumers, with only 10% of participants of the same survey being willing to trust a computer algorithm above and beyond a real, flesh and blood human being.

Simply put; consumers are the least likely to seek completely automated customer service, especially for personal mortgages and high impact investing. And even fewer of them trust the decision-making “skills” of intelligent software.

So, why all the distrust for artificial intelligence? In my view, consumers may not know what they do not know. There’s money to be made for financial service providers and consumers alike with the help of AI.

Master the AI technology with AI Tutorial Series by DataFlair

AI in Online Banking

Let’s take a step back from the finance industry as a whole and look only at online banking; how can AI positively impact the online banking experience.

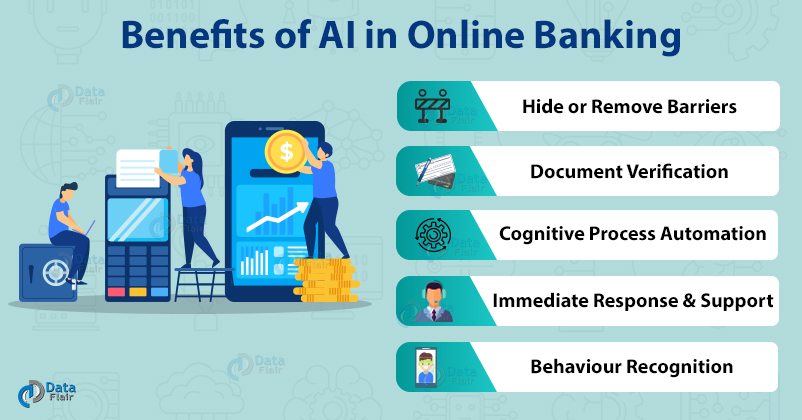

1. Hide or Remove Barriers

The internet is rife with hidden complexities, but when it comes to online banking those complexities are front and center, creating barriers for some demographics.

In fact, according to Experian, 42% of millennials would conduct more online banking transactions if there weren’t so many security hurdles they are required to overcome. That statistic drops to 30% among respondents 35 and older, but it’s still a huge sticking point for businesses.

Biometrics used as identification could change all that. With artificial intelligence and three-dimensional face-based biometrics, financial institutions can provide login experiences that are more secure than two-factor authentication or outdated KBA and provide reliable authentication without a traditional password.

Fewer passwords to remember, and let’s be real, millennials know their way around their phone’s front-facing camera.

2. Document Verification and Cheque Cashing

Cheques are so boomer, said every millennial, ever. Who even uses cheques anymore?

In spite of popular opinion, cheques aren’t going anywhere just yet, and neither are physical IDs or documents during the account verification process.

Where banks once spent billions on human document verification, artificial intelligence can verify document authenticity in seconds from start to finish.

Scan utility bills, bank statements, cheques, and much more, all while meeting KYC compliance and EU AML directives.

3. Cognitive Process Automation

Banks can now automate information-intensive services that were once error-prone and costly to facilitate with artificial intelligence which is a huge win for financial institutions, and one that enables them to pass on savings to clients.

Claims management being one such process, although it’s possible to fundamentally automate just about any set of tasks that once required human improvisation.

4. Immediate Response and Support

With AI, there is no such thing as a banker’s holiday; realistic interactive interfaces powered by chatbots can solve the problem on the fly. They work with customers to come to a solution or answer a question without any human involvement.

Forcing customers to await responses to support tickets is no longer required. As a majority of customer engagements can be handled in-app or on the online banking website.

5. Behaviour Recognition

Observing and analyzing consumer behavior can help financial institutions identify areas where they can improve, put forward commonly used services and tools and center in a personalized dashboard.

And, react to user activity that may be fraudulent like a sudden change in location that may occur in man-in-the-middle attacks.

Only when something seems ‘off’ will a user be requested to jump through a proverbial security hoop, as opposed to every single time they log on.

Summary

Artificial intelligence helps financial institutions put resources where they matter, and repetitive tasks can be eliminated.

For the customer, the technology can provide peace of mind and a more robust online banking experience which is faster and less time-intensive.

Time to explore the Applications of AI in different sectors

Did we miss anything? Let everyone know what you think in the comments.

If you are Happy with DataFlair, do not forget to make us happy with your positive feedback on Google