Types of Banks in India – Indian Banking Sector

Are you ready for UPSC Exam? Check your preparation with Free UPSC Mock Test

The process of modern banking in India began in the late 18th century. The oldest profit-oriented bank is the ‘Bank Of Calcutta’ started in 1806 and is presently known as the ‘State Bank Of India’. Currently, there are 34 banks in India, out of which 12 are public sector banks and 22 are private sector banks.

Banks have helped boost the economic development of the country and have encouraged a culture of saving amongst the people of the country. Let us learn about the various Types of Banks in India.

History of Banks in India

- Ancient India included the use of ‘Usury’. There was also the existence of loans called ‘Rnapatra’, ‘Rnapanna’, or ‘Rnalekhaya’. Moreover, there was the use of ‘Adesha’ or ‘Letters Of Credit’.

- In the Medieval Era, there was a use of ‘Dastawez’ including the ‘Dastawez-E-Indultalab’ and the ‘Dastawez-E-Miadi’.

- In the Colonial Era, the ‘Bank Of Calcutta’ was established in 1806 and is the oldest bank which is still in function just with a change in title originally formed by the presidency government.

- Also, the ‘Commercial Bank’ started in 1845.

- The ‘Union Bank of Calcutta’ was started in 1829 replacing the ‘Bank Of Calcutta’ and the ‘Commercial Bank’.

- The ‘Bank of Hindustan’ started in 1770 but shut down in 1829 – 1832.

- The ‘General Bank of India’ started in 1786 but disassociated in 1791.

- The ‘Bank Of Bombay’ started in 1840 formed by the presidency government.

- The ‘Bank Of Madras’ started in 1843 formed by the presidency government.

- The 3 banks formed by the presidency government were then combined to form the ‘Imperial Bank Of India’ in 1921.

- The ‘Reserve Bank Of India’ started in 1935.

- According to the State Bank of India Act, 1959 the ‘State Bank Of India’ was given under the supervision of 8 connected banks.

- In 1969, 14 major private banks nationalized including the ‘Bank of India’. In 1980, 6 more banks were nationalized.

- The ‘Allahabad Bank’ started in 1865.

- The ‘Grindlays Bank’ started in 1864, Calcutta.

- The ‘Comptoir d’Escompte de Paris’ started a branch in 1860, Calcutta and another in 1862, Bombay. More branches formed in Madras and Pondicherry functioned too.

- The ‘HSBC’ was started in 1869, Bengal.

- The ‘Oudh Commercial Bank’ started in 1881, Faizabad.

- The ‘Punjab National Bank’ started in 1894, Lahore.

- The ‘Catholic Syrian Bank’, ‘The South Indian Bank’, ‘Bank of India’, ‘Corporation Bank’, ‘Indian Bank’, ‘Bank of Baroda’, ‘Canara Bank’ and ‘Central Bank of India’ were a few banks which came up around the time of the Swadeshi movement.

- After independence, the ‘Reserve Bank Of India’ started in 1935 and nationalized in 1949.

- The ‘Allahabad Bank’, ‘Bank of Baroda’, ‘Bank of India’, ‘Bank of Maharashtra’, ‘Central Bank of India’, ‘Canara Bank’, ‘Dena Bank’, ‘Indian Bank’, ‘Indian Overseas Bank’, ‘Punjab National Bank’, ‘Syndicate Bank’, ‘UCO Bank’, ‘Union Bank of India’, ‘United Bank of India’ were nationalized in 1969.

- ‘The Punjab and Sind Bank’, ‘Vijaya Bank’, ‘Oriental Bank of India’, ‘Corporation Bank’, ‘Andhra Bank’ nationalized in 1980.

- Liberalization took place by the government in the 1990s. The private banks also included the ‘Global Trust Bank’, ‘IndusInd Bank’, ‘UTI Bank’, ‘ICICI Bank’, and ‘HDFC Bank’.

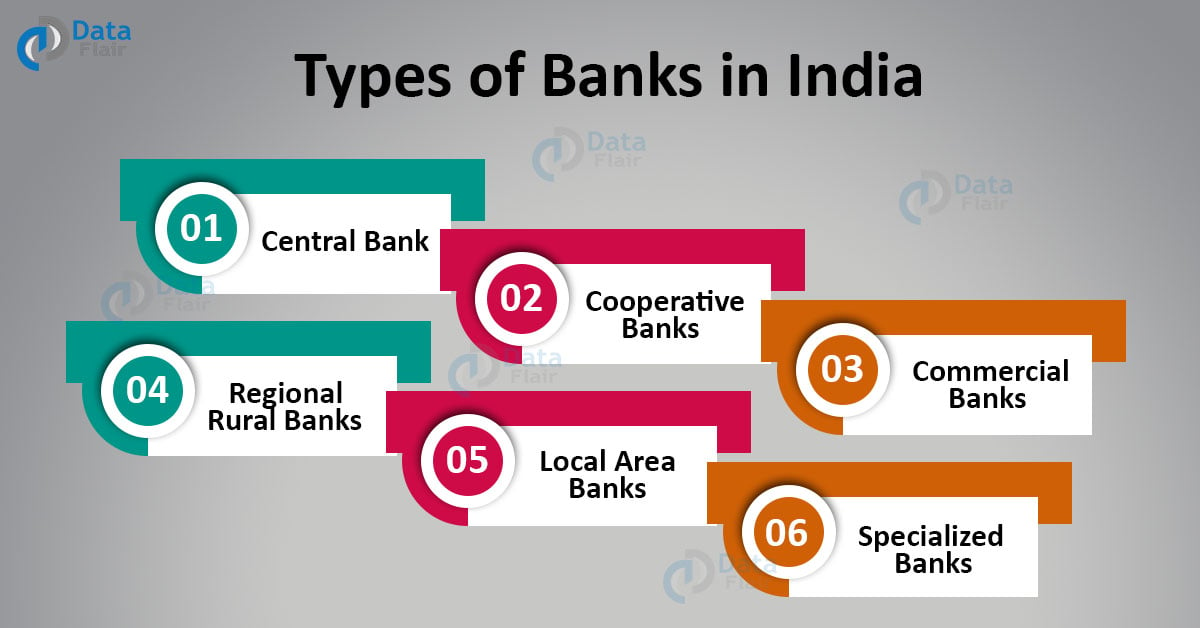

Types of Banks in India

There are several types of banks in India that are broadly divided into 2 categories i.e. Scheduled Banks and Non – Scheduled Banks.

Scheduled Banks

1. Central Bank

- A chief bank that keeps a check on and synchronizes with all the other banks in a particular country is known as the Central Bank of the country.

- In India, the post of the Central Bank is that of the ‘Reserve Bank of India’ (RBI).

- The RBI is also known as the ‘government’s bank’ or the ‘banker’s bank’.

- The RBI is responsible for regulating and guiding other banks in the country.

- It emanates the currency of the country i.e the Indian Rupee.

- It executes and carries out financial and monetary strategies, approaches, and determining policies.

- The RBI overlooks the pecuniary system of the country by handling the finances.

- It is also responsible for foreign exchange.

- All of these functions always take place under the supervision of the government of the country.

2. Cooperative Banks

- Such banks operate under the state government’s act.

- The main objective of these banks is to ensure the social well – being of the public.

- This is done by offering loans that are open to concession based on user comfort.

- These have a 3 level format:

Level 1: The state-level cooperative banks include The RBI, government, and NABARD finance. Public distribution of money takes place. Concessional CRR, SLR charges also apply upon these banks. (CRR- 3%, SLR- 25%).

The ownership belongs to the state government and the various members choose the major management.

Level 2: The district-level cooperative banks. These are set up to enhance development in the agricultural sectors of majorly the rural areas. But they also run non – agricultural cooperatives with other unions, etc. Each district has a district-level bank in India.

These banks are together represented by a State Apex Central Co-operative bank for each state. The members indulge in multiple different professions. These banks get loans at an interest rate of 1% to 2% lower than the standard bank rate

Level 3: The rural or village level cooperative banks with their main focus on primary agriculture. NABARD is responsible for keeping a check on these banks. Primary Agricultural Credit Societies (PACs) exist on this level which works on grassroots levels.

This help provides short and middle term loans to their members and acts as a link between the higher financial institutions of the country and their members. As of March 2018, there were 96248 such banks in the country.

Non – Scheduled Banks

3. Commercial Banks

- Such banks operate under the Banking Companies Act of 1956.

- These are often run by either the government or any private firm.

- The major aim of such banks is to earn maximum profit through their commercial policies.

- The deposit amount by its users acts as a major resource of its reserve.

- Concessional interest fares are only offered when directed by the CBI.

- These are appropriate for operation in both urban and rural areas.

These further have 3 major types:

a. Public Sector Banks: The denominating shareholder is either the government or the central bank of the country.

b. Private Sector Banks: The denominating shareholder is either an individual, some private organization, or a selected group of individuals.

c. Foreign Banks: Such banks have their head offices and main operating systems in a foreign country with their branches in India.

| Public Sector Banks | Private Sector Banks | Foreign Banks |

| State Bank Of India | Catholic Syrian Bank | Australia and New Zealand Banking Group Ltd. |

| Allahabad Bank | City Union Bank | National Australia Bank |

| Andhra Bank | Dhanlaxmi Bank | Westpac Banking Corporation |

| Bank Of Baroda | Federal Bank | Bank Of Bahrain & Kuwait BSC |

| Bank Of India | Jammu and Kashmir Bank | AB Bank Ltd. |

| Bank Of Maharashtra | Karnataka Bank | HSBC |

| Canara Bank | Karur Vysya Bank | CITI Bank |

| Central Bank Of India | Lakshmi Vilas Bank | Deutsche Bank |

| Corporation Bank | Nainital Bank | DBS Bank Ltd. |

| Dena Bank | Ratnakar Bank | United Overseas Bank Ltd. |

| Indian Bank | South Indian Bank | J.P. Morgan Chase Bank |

| Indian Overseas Bank | Tamilnad Mercantile Bank | Standard Chartered Bank |

| Oriental Bank Of Commerce | Axis Bank | Total Banks include 40 of them. |

| Punjab National Bank | Development Credit Bank | |

| Punjab & Sind Bank | HDFC Bank | |

| Syndicate Bank | ICICI Bank | |

| Union Bank of India | Induslnd Bank | |

| United Bank Of India | Kotak Mahindra Bank | |

| UCO Bank | Yes Bank |

| Vijaya Bank | IDFC | |

| IDBI Bank | Bandhan Bank Of Bandhan Financial Services |

4. Regional Rural Banks

- Operating under the Regional Rural Bank Act of 1976, these banks started in 1975.

- These banks aim at the development of rural and agricultural areas with the help of concessional loan offerings.

- The establishment of 196 has taken place in between 1987 – 2005.

- The ownership of these banks belong 50% to the national government, 15% to the state government, and 35% to the commercial bank.

- 3 geographically consecutive districts cannot have the branches of the same Regional Rural Bank.

- From 2005 onwards, the merging of these banks took place then by the government due to which the number reduced to 86.

5. Local Area Banks

- Operating under the Companies Act, 1956 these banks originated in the year 1996.

- These are commercially driven banks with the aim of earning profit.

- These are run by private firms.

- Currently, in India, there are 4 Local Area Banks located in the southern part of India.

6. Specialized Banks

- Banks which started for determined purposes are Specialized Banks.

- The ‘Export and Import’ (EXIM) Bank is a part of the specialized banks. Export and import finances take place and loans occur via these banks.

- Commercial and monetary responsibilities regarding rural artworks, handicrafts, villages, and agricultural development often take place by the ‘National Bank for Agricultural & Rural Development’ (NABARD).

- The Small Industries Development Bank of India (SIDBI) offers loans for small scale industries and also upgrades them in terms of technology and equipment.

- These are responsible for the economic and industrial development of the country.

7. Small Finance Banks

- Regulated and controlled by the national government of the country.

- Responsible for offering finances and loans to minor businesses and trades such as farming or the poor unorganized sector.

| Name of some Small Finance Banks |

| AU Small Finance Bank |

| Capital Small Finance Bank |

| ESAF Small Finance Bank |

| Equitas Small Finance Bank |

| Fincare Small Finance Bank |

| Utkarsh Small Finance Bank |

| Jana Small Finance Bank |

| Suryoday Small Finance Bank |

| Northeast Small Finance Bank |

| Ujjivan Small Finance Bank |

8. Payments Banks

- This latest introduction to the banking format design took place by the RBI.

- The maximum deposit accepted in these banks is that of Rs.100000.

- There is no facility of loans or credit cards available in such banks.

- Net, online, mobile, ATM, and debit card banking can take place via.

| Name of some Payment Banks |

| Airtel Payments Bank |

| India Post Payments Bank |

| Fino Payments Bank |

| Jio Payments Bank |

| Paytm Payments Bank |

| NSDL Payments Bank |

Conclusion

The above article increases awareness of the history and types of banks present in India. It also boosts preparations for competitive exams. Many well-known banks are also classified into the given categories.

This article also explains how various institutions link to each other and where their services are best available. This encourages people to sensibly invest in their choice of bank by granting them enough knowledge on how each bank works. Add more content

Your 15 seconds will encourage us to work even harder

Please share your happy experience on Google

Awsome content.. Loved it.

Thankyou so much for the post. It was really helpful for my banking project. Once again thank you so much….