Types Of Bank Accounts in India

Are you ready for UPSC Exam? Check your preparation with Free UPSC Mock Test

A bank account is an association with an established bank that may involve submitting deposits, withdrawing amounts, passing on loans, creating transactions, and receiving or paying interest on the amount.

This boosts the overall economic development of the country and develops a habit of saving across the people. It is a convenient way to civilize funds, remunerations, and earnings. Let us learn about the types of Bank accounts in India.

Benefits of Having a Bank Account

- It helps collect and save monetary assets which can then come to use when required as it also helps earn the profit.

- There is an ever-ready pool of deposit available in case of urgent situations.

- The bank documentation acts as proof of identification for all bank members.

- Clarity of balance amount and transactions via passbook.

- Security of monetary and other assets due to the provision of lockers by the bank etc and most importantly it remains insured.

- The bank acts as an agent for its client. Various bills can easily pass through the associated bank along with other transactions.

- Cheques, credit cards, debit cards, etc are accessible facilities by the bank.

- It’s an easy way to earn a profit on deposited money as the bank offers interest on the amount.

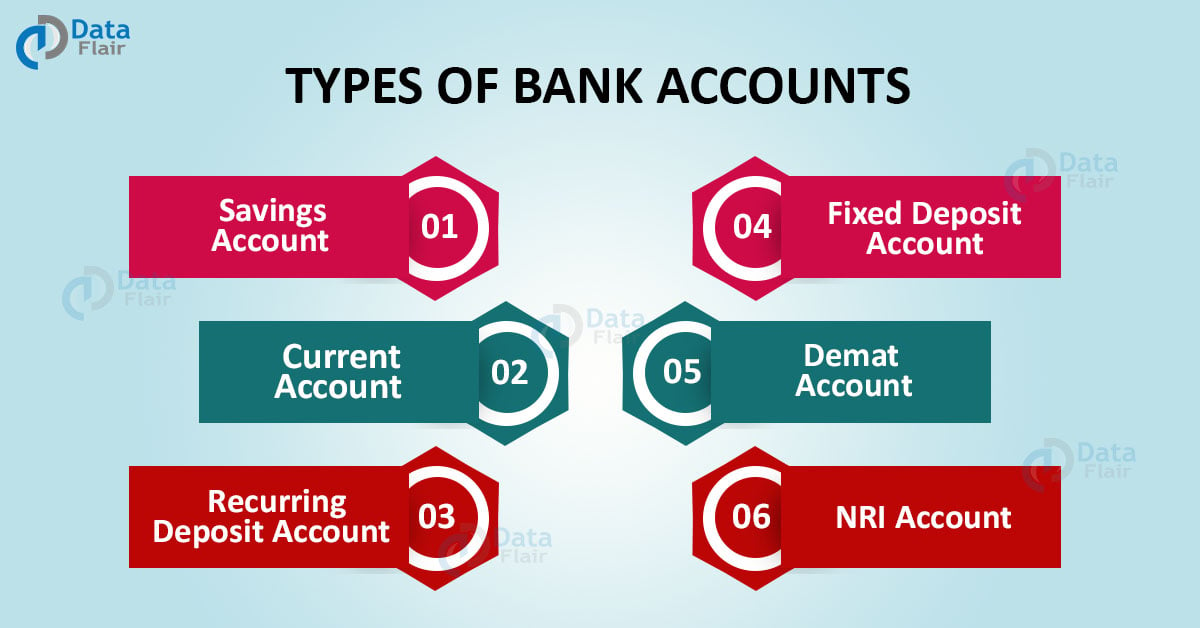

Types of Bank Accounts

There are several types of bank accounts which include:

1. Savings Account

- There are 2 major savings accounts which include: Basic Savings Bank Deposit Accounts (BSBDA) and Basic Saving Bank Deposit Accounts Small scheme (BSBDS).

- The interest rate of the savings account received by the user is about 4% to 5% annually.

- Apart from these, there exists a regular savings account that has many features. This is appropriate for those receiving remuneration, for those receiving the pension, and for students.

- There is a provision of 2 complimentary cheque books annually.

- The option of modest credit is always open to the depositor.

- Students can create their account without any balance on the basis of enough documentation required.

- The BSBDA is a regular banking facility. There is a provision of several cards such as the ATM, Debit, Rupay card, etc without the existence of a minimum deposit amount.

- However, in the BSBDA there is a provision of only 4 withdrawals in a month with no limits on deposits made.

- Facilities such as activation of an account, or remaining of an inactive account are not charged for.

- Overdraft provisions account for up to Rs.5000.

- The BSBDS facility requires conformational proof of address and photograph.

- The credit limit is a maximum of Rs.100000 annually.

- Rs. 50,000 is the maximum balance.

- Transfers and withdrawals have a limit of Rs.10000 monthly.

- ‘Know Your Customer’ formality details are essential for transactions involving foreign accounts.

- To hand – operate the bank account conditions, there is permittance of an opening at Core Banking Solution branches or similar ones.

2. Current Account

- This account is appropriate for single account holders, joint account holders, businesses, charitable institutions, religious institutions, educational institutions, associations, clubs, limited companies, etc.

- There is no pay off the interest on these accounts.

- There is the provision of overdraft and internet banking facilities.

- There is no limit to making remittances, withdrawals, or deposits.

- Transfer of funds takes place from all over the country.

- There is no fixed duration of the maturity of such accounts.

3. Recurring Deposit Account

- This account is appropriate for single account holders, joint account holders, RBI-allowed agencies and institutions, clubs, associations, etc.

- The account duration ranges from 6 months to 120 months, in a multiple of 1 month.

- Installments remain permanently fixed and unaltered.

- Occasional installments can be as low as Rs.50.

- The installment amount is monthly due at the beginning of the selected scheme.

- Granting of a pas book takes place to the depositor of the amount.

- Compounding of interest fare takes place every quarter.

- The payment of the total amount after the maturity of the duration to the associates a happens a month after the last installment.

- Tax Deducted at Source’, charges are there on the interest on cumulative deposits too due to changes in the ‘Income Tax Act’.

- The facility of nomination is also available in these accounts.

- A penalty fine charge is on the withdrawal of deposit before the maturity of duration.

- The interest rate varies with the chosen bank.

4. Fixed Deposit Account

- These accounts are of 2 types: Short Deposit Receipt (SDR) and Fixed Deposit Receipt (FDR).

- The creation of the deposit takes place for a predetermined fixed amount of time.

- The bank acquires deposit amounts from users from a range of 7 days to 10 years.

- SDR refers to the scheme in which the duration range of acquiring deposits is from 7 days to 179 days.

- In the duration of 7 days to 14 days, the minimum deposit amount required is at least Rs.5 lakhs.

- FDR is appropriate for single account holders, joint account holders, clubs, societies, associations, minors, etc.

- Interest rates paid by the chosen bank vary depending on the bank and its changes along with the duration of the deposit.

- Government scheme subsidies will not include margin money, earnest money, court deposits, minimum amount criteria, etc.

- In urban area branches, the minimum FDR is Rs.10000 and in rural area branches, and for senior citizens, the minimum FDR is Rs. 5000.

- Repayment of deposit before the maturity of duration happens.

- An extra 0.5% interest fare adds to the deposit of a senior citizen placed for more than a year.

- The deposit withdrawal takes place all at once and not in installments.

5. Demat Account

- Appropriate for financial institutions, clearing members, mutual funds, foreign national, corporate, trusts, banks, depository accounts, individuals, non – resident Indians, etc.

- Used for safe transactions of shares where the transaction price reduces and so does the paperwork.

- Traders can participate from anywhere as it leads to an easy and convenient trade.

- Only the ‘National Securities Deposited Limited’ and ‘Central Depositary Services Limited’ cater to these kinds of accounts in India.

- Applications include filling the form, submission of the photo, and a copy of Voter ID or Passport or Aadhar card or Driving License, etc after which a DEMAT account number is given. Hence, ‘Know Your Customer’(KYC) works for the opening of an account.

- Provisions under these accounts include – creating and organizing of Demat accounts, dematerialization, rematerialization, buys, sales, pledging, and unpledged the security of funds.

6. NRI Accounts

- There are 3 types of NRI accounts: Non-Resident Ordinary (NRO) Rupees Account, Non-Resident External (NRE) Rupees Account, and Foreign Currency Non-Resident (FCNR) Account.

- Nominations permission takes place in all the 3 types of accounts.

- The decided interest rate on the deposit by the bank exists in all the 3 types of accounts.

- NRO is appropriate for single account holders, joint account holders, or any individual resident outside India. This permits the easy transfer of foreign remunerations to India. They exist in the form of Fixed Deposit or Recurring Deposit or Current or Savings accounts. The denomination of money is in Indian Rupees. The period for fixed deposits is as applicable to resident accounts. It is non – repatriable. There is a ‘Tax Deducted at Source’ on Interest acquired on deposits at 30.90%.

- NRE is appropriate for NRI, PIO, OCI, joint account holders, and individuals of Bangladesh and Pakistan requires the approval of RBI. This occurs when an Indian citizen is working abroad. They exist in the form of Fixed Deposit or Recurring Deposit or Current or Savings accounts. The denomination of money is in Indian Rupees. The duration for fixed deposits ranges from 1 year to 10 years. It is repatriable. There is no tax that is ever deducted.

- FCNR is appropriate for NRI, PIO, OCI, joint account holders, and individuals of Bangladesh and Pakistan requires the approval of RBI. This account helps in managing the transactions of foreign currency. They exist in the form of Term Deposit only. The denomination of money is in the US dollar, pound sterling, Yen, Euro, Australian dollar, and Canadian dollar. The duration for fixed deposits ranges from a minimum of 1 year to a maximum of 5 years. It is repatriable. There is no tax that is ever deducted.

7. Checking Accounts

- The major transactions of these accounts take place through credit cards, debit cards, ATM withdrawals, or the writing of cheque transactions.

- These help in clearing the everyday expenditures experienced.

- A monetary amount of deposits also exist.

- These happen through online banking, payments, and clearance of expenditure.

- Usually, traditional accounts do not offer any interest at all on the amount of deposit.

- When interest on such account deposits occurs – it is more than the interest received from the deposits offered on the savings account.

- Storage of the amount for a short duration is possible via these accounts.

- These are appropriate for people who maintain a small account balance.

- However, these include several processes of payment of monthly fees and other tedious restrictions.

- Despite this, some accounts are not subject to such high maintenance amounts.

- Several processes take place in a faster manner – like the deposit of remunerations, wages, salaries, etc.

- This also helps prevent fraud, cheats, and theft.

8. Money Market Accounts

- This is a combination of savings and checking accounts.

- These have the highest interest fares out of the savings and checking accounts on the deposits made.

- There are barely any cheque – writing benefits.

- These can be both for short and long durations.

- These are appropriate for those carrying a huge balance amount in their bank deposits.

- There is a requirement to pay high fees and minimum balance amount in such accounts.

- Monthly withdrawals are available just 6 times just like in the savings account.

- These are available as urgency funds with enough deposits.

- Low maintenance accounts are available too.

- These also offer provisions that are low in cost.

9. Certificates Of Deposit

- This account has a fixed deposit duration of 3 months – 5 years.

- Withdrawal beforehand leads to a penalty.

- This also ensures maximum earning compared to other accounts.

- This helps successfully implement planning of events requiring a huge amount of money.

- These are available for both a short and long duration.

- The availability of a CD ladder is there to make available a small pool of money at regular intervals.

- Certain banks also offer many benefits, low maintenance charges, and more convenient policies.

10. Retirement Accounts

- These offer ‘Individual Retirement Arrangements’ to save funds for the after retirement duration.

- These include 401(k) accounts too.

- Such accounts are also offered for small business houses.

- These provide several tax reductions and also tax redemption which depends on the arrangement selected.

- They allow investments in the stock market.

- These take place for a long duration of time to earn large account balances.

- Early fund withdrawal leads to payment of taxes without any given federal insurance.

- These require long term planning.

- These are well connected with company programs as well.

- Various services, advisors and policies may connect to get the provision of maximum benefits.

Conclusion

This article increases general awareness of the various types of bank accounts. It helps prepare well for competitive examinations. Along with this, it encourages people to invest in a bank and an account of their choice which they can independently choose on the basis of the knowledge provided above.

If you are Happy with DataFlair, do not forget to make us happy with your positive feedback on Google