Quantity Theory of Money and Keynesian Theory of Money

Are you ready for UPSC Exam? Check your preparation with Free UPSC Mock Test

A money multiplier is one of the most significant closely related ratios of the commercial bank’s money to the central bank’s money. Various economists studied the money multiplier quantity theory of money.

Let us learn more about it in detail:

The Quantity Theory of Money – Fisher’s Version

Similar to the price of a commodity, the value of money is also determined by the supply of money and the demand for money. In his theory, Fisher attached weight on the worth of money as a medium of exchange. In other words, transaction purposes demand money.

Fisher gave the Approach of the transaction to the Quantity theory of money.

According to the theory,

MV=PT

- Here, M stands for the total supply of money.

- V stands for the velocity of circulation of money.

- P stands for price.

- And T stands for transactions in physical goods.

According to the equation, the total value of the goods sold during any period should be equal to the total quantity of money spent during that period.

Assumptions of Transaction Approach

- The price level is measured over some time.

- No credit sales exist in the market.

- The money unit can change several hands during the said time.

- The cash payments received equal the goods and services sold.

- Money is the sole medium of exchange.

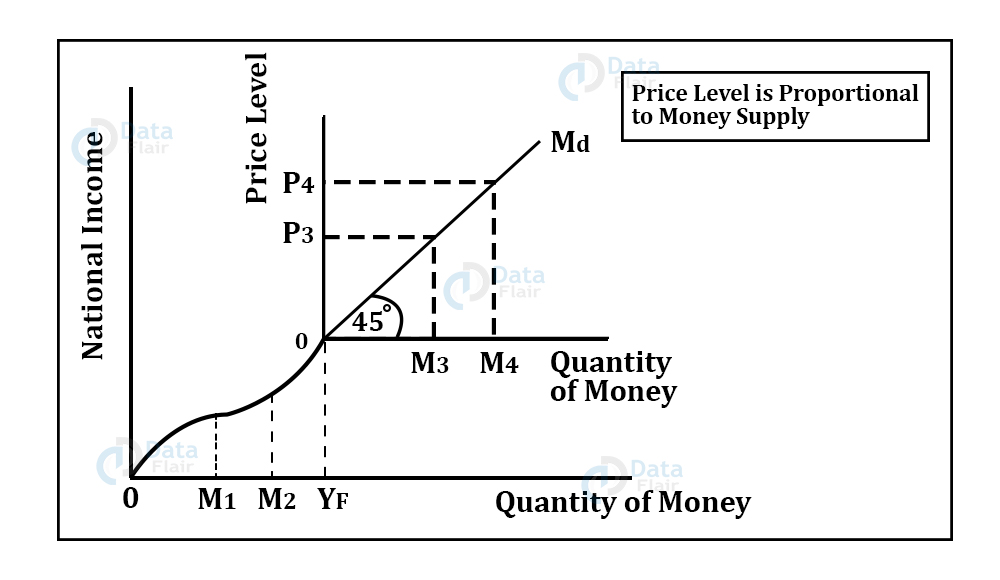

It is hence concluded that there is a directly proportional relationship between the price level and the supply of money.

Technology is evolving rapidly!

Stay updated with DataFlair on WhatsApp!!

Or we can say that an increase in the price levels will lead to an increase in the quantity of money circulated in the economy.

Therefore, the stock of money defines the price level. People keep money more than their need for transactions when there is an uptick in the money supply.

The holding of money is worthless. Soon, they spend the money. This additional expenditure raises the price level, employment being constant.

Now, a rise in the price level indicates an increase in the value of transactions and, therefore, the demand for money rises. This process will continue until the equality between the demand for and the supply of money is re-established.

The cash transaction version can be extended by including the bank deposits in the definition of the money supply. The money supply comprises not only legal tender money, M but also the bank money, that is, M’. This bank money also has a stable velocity of flow, that is, V’.

This means that the new equation comes out to be –

MV + M’V’ = PT

Here,

- M stands for currency

- M’ stands for Bank’s money

- And V and V’ stands for the respective velocities.

The Quantity Theory of Money: Cambridge Version

This theory came up in the early 1990s by several economists which include Pigou, Marshall, Robertson, and Keynes. Economists that the money acts both as a store of wealth and a medium of exchange.

Cash balance and the money balance is the amount of money that people want to hold rather than savings.

The Cambridge economists believe that people wish to cash to finance transactions and for the security against the unforeseen needs. They believed that an individual’s demand for money or cash balances is directly proportionate to his income.

This means a rise in income leads to an increase in the demand for money or cash balances.

Limitations of the Model

1. Aggregate demand influences the price level

Keynes critique that the price level in an economy is not influenced by the money supply. He believed that an increase in the money supply is equivalent to an increase in effective demand.

2. Much emphasis on the money supply

One cannot ignore that there are a lot of factors that influence a change in the price level, except for the mere money supply. However, the quantity theory emphasizes too much over the money supply.

3. M influences P via interest rate

Critiques believe that there is not a direct relationship between the money supply and the price level. Fisher has ignored the influence of the rate of interest on the price level.

4. Inoperative below full employment

The critics argue that the theory does not work below the full employment level, which is the actual case in the real market.

5. V, T, and more do not remain fixed

In an economy that keeps on changing now and then, V, T, V’, and the ratio of M to M’ also keeps on changing and does not remain constant or fixed.

6. It is an identity

Fisher’s equation is an identity, which says that MV and PT are equal. But, the quantity theory of money is a hypothesis and not an identity that stands always true.

Keynes Theory on Demand for Money

Keynes believed that the three motives that drive the money demand are –

- Transaction motive

- Precautionary motive

- Speculative motive

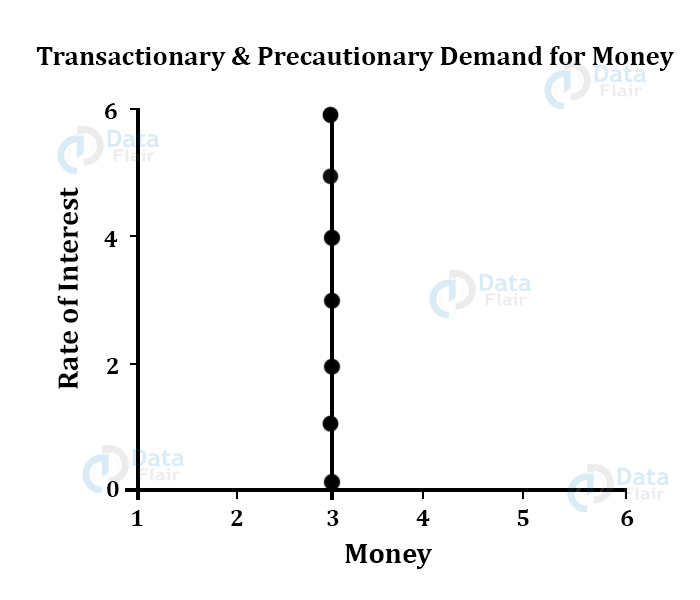

The transaction motive refers to the need for cash to make different kinds of transactions. This further means that money is the medium of exchange in the market. The transaction motive can be further divided into two types. One is from the view of the producer, ie. the income motive.

Herein, the demand for money or the need for cash for the current transactions of individual and business exchanges. The other one is the business motive, wherein the businessman also needs to keep a proportion of their resources ready in cash.

The precautionary motive refers to the public holding the money discerning the sudden expenditures that might take place.

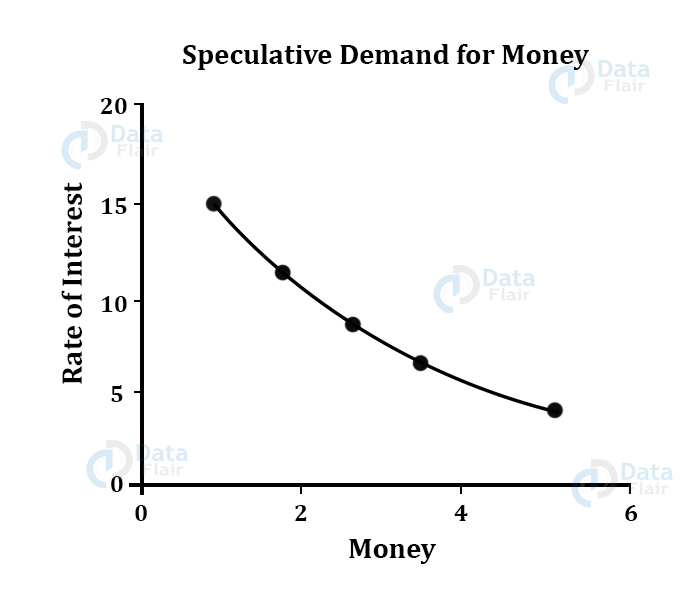

Out of all the three, it is believed that the speculative motive is the most important contribution of Keynes that is made to the theory of money demand. Because this motive explains the reason behind the public holding surplus cash into their hands rather than keeping it in the banks.

It is said that there is a negative relationship between the demand for money and the rate of interest because an increase in the rate of interest leads to a fall in the bond prices. This further induces a lower demand for money.

The demand for money will be lower because due to a fall in the bond prices, the public would want to buy more of the bonds.

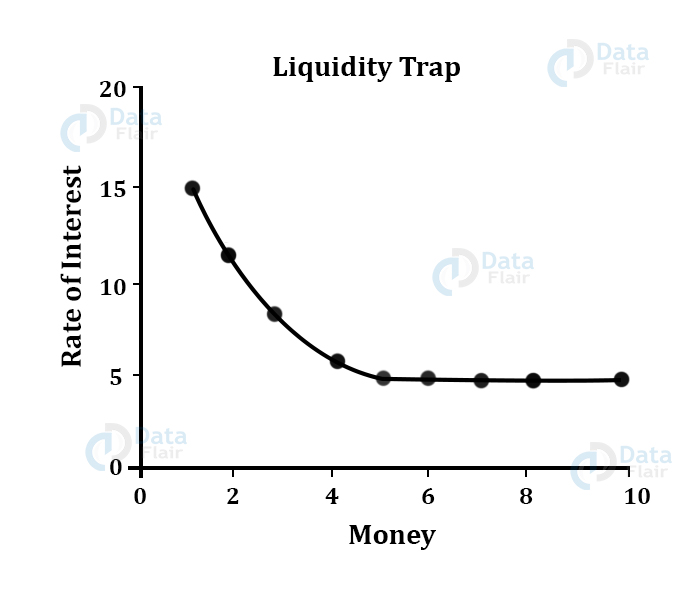

Liquidity Trap

Under a liquidity trap, the rate of interest is so low that the demand for money becomes infinitely elastic. Adding to that, the supply of money will not affect the rate of interest and income.

Goals and Instruments of Monetary Management in Closed and Open Economies

Monetary policy relates to the changes in the supply of money and credit. These are the measures that are undertaken by the government or the central bank to influence the availability, cost, and the use of money.

The economic activities are influenced by the help of money or credit supply, and the rate of interest.

The goals of the Monetary management are the objectives of it that are reached with the help of several instruments. So, one should study the goals and the instruments used to achieve them together. –

1. Stabilization of the Business Cycle

The monetary policies hold a significant impact on the actual Gross Domestic Product and the potential Gross Domestic Product. However, Keynes quotes that the monetary policies are not effective during the existence of the liquidity trap situation and the low-interest elasticity of investment.

2. Price Stability

It is one of the most essential goals of monetary policies. In a condition of either inflation or deflation, monetary policies help in stabilizing the price in the economy. The stability of price also encourages the country’s balance of payment.

3. Fasten the Economic Growth

By making the credit cheaper and more readily available, the monetary policies help to fasten the economic growth. There are two types of credits- the long term credit and the short term credit. And both of these credits can be met through the development and the commercial banks in the country.

A higher interest rate can induce the public to invest more, hence aid economic growth.

4. Stability of the Exchange Rate

The exchange is another vital element in a closed economy. To prevent a huge depreciation or appreciation of the rupee in terms of Dollars or other foreign currencies.

Some of the instruments of monetary management are –

- Manipulating the level of interest rates.

- Influencing the public’s propensity to spend.

- Influencing the ways of financing.

- Regulating the creation of money quantitatively.

- Influencing net import and net export of the capital.

Relation Between the Central Bank and the Treasury

Effective Cash Management

This function arises from the mismatch between the timings of the payments and the availability of the cash. “The strategy and associated processes for managing cost-effectively the government’s short term cash flows and cash balances, both within government and between government and other sectors.”

Goals of Cash Management

There are several goals of Cash management. It works towards achieving adequate cash that is needed to pay for the expenditures and believes that one should only borrow when they are needed to maximize the borrowing costs.

Another goal is to maximize the returns on idle cash. And the last but not the least is to manage the risk by investing temporary surpluses effectively against the adequate collateral.

Nine plus three Principles of Effective Cash Management

- Centralizing the government cash balances, also known as, TSA system.

- Defining the coverage of the cash management framework.

- Accurately projecting the short term cash outflows and inflows.

- Adequate transaction processing and accounting framework.

- Timely sharing of information between the treasury,

- Revenue collecting agencies,

- and spending ministries.

- Appropriate institutional arrangements and

- Clear responsibilities.

The three desirable features are –

- Utilization of modern banking, payment, and settlement systems.

- The use of short term financial market instruments for cash management.

- Integration of the debt and cash management.

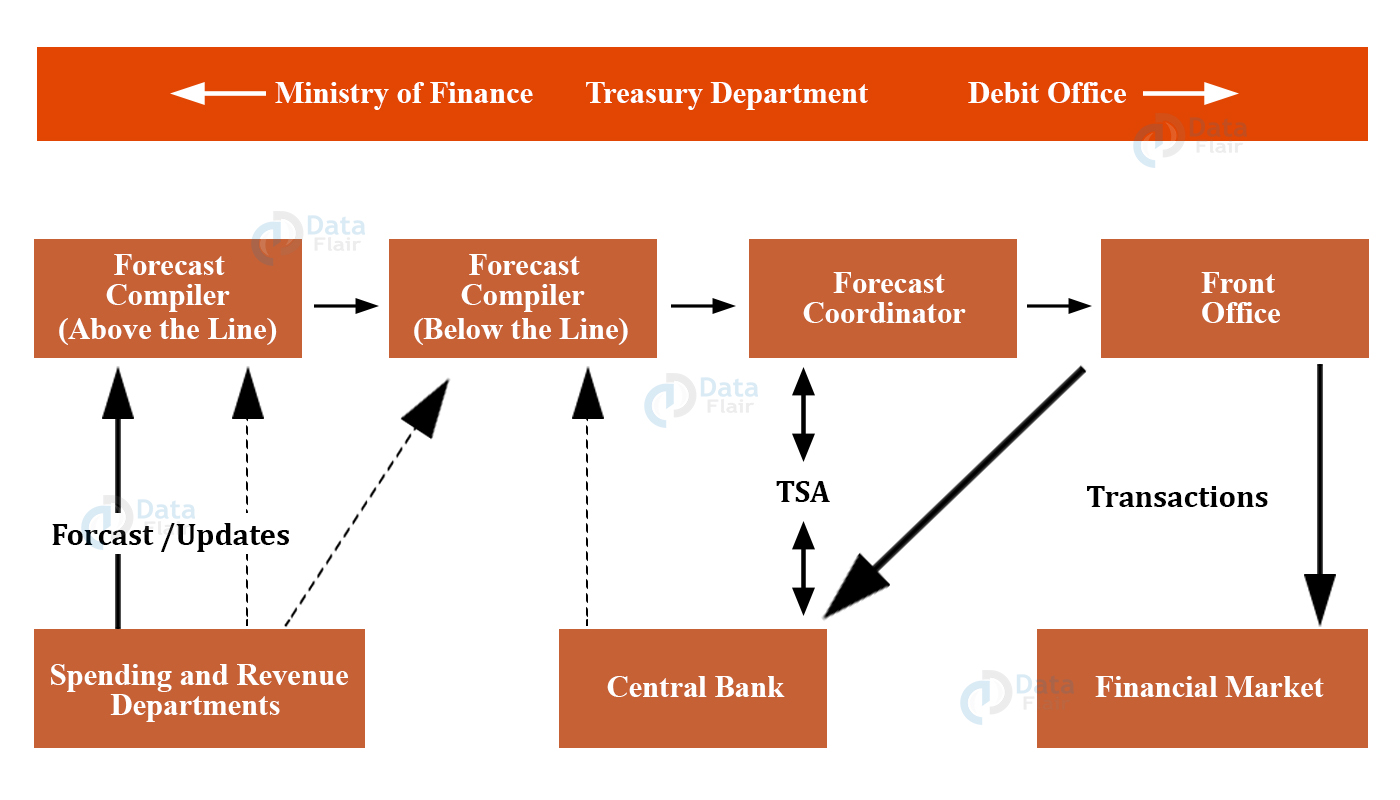

Responsibilities for Forecasting

The table below exhibits the various responsibilities for forecasting by different organizations in the market.

The relationship occurs at various levels that are –

Summary

We looked at how price affects the economic conditions and the economic stability of a nation like India. We also considered the concept of monetary policies that help in maintaining stability and escalating economic activities.

These monetary policies can either be regulated by the government or the central bank of the country.

You give me 15 seconds I promise you best tutorials

Please share your happy experience on Google