Economic Growth and Development Theories

Are you ready for UPSC Exam? Check your preparation with Free UPSC Mock Test

In this Economics Tutorial, we will learn various theories for Economic Growth and Development. We will also see factors affecting the Economic Growth of any country. Let us start our learning.

Harrod Domar Economic Growth Model

According to the Harrod Domar Model, the rate of economic growth depends on two things, that is, the level of savings, and the capital-output ratio. The model said that

The rate of economic growth equals the Level of output upon Capital output ratio. The level of savings is the Average Propensity to save, which is the ratio of national savings to national income. The capital-output ratio is the amount of capital needed to increase the output.

The model believed the main factors that affect economic growth are-

- Savings Ratio

- Marginal efficiency of Capital

- Minus Capital Depreciation

Warranted Growth Rate – As a part of his growth model, Roy Harrod introduced the concept. He explained it to be the growth rate at which investment absorbs all the savings. Further, It is the growth rate at which the ratio of capital to output would stay constant at four.

The Natural Growth Rate is the rate of economic growth required to maintain full employment. And this assumes that there is no change in the productivity of labor. But, this assumption is unrealistic.

Importance of the Harrod Domar Model

In developing countries like India, low rates of economic growth and development are linked to low saving rates, which further creates a vicious cycle of low investment, low output, and low savings.

To boost the economic growth rates, it is essential to increase the savings either domestically or from abroad. The higher savings create a worthy circle of self-sustaining economic growth.

Technology is evolving rapidly!

Stay updated with DataFlair on WhatsApp!!

The transfer of capital to the developing economies will facilitate higher growth, which in turn will lead to higher savings and the growth will become more self-sustaining.

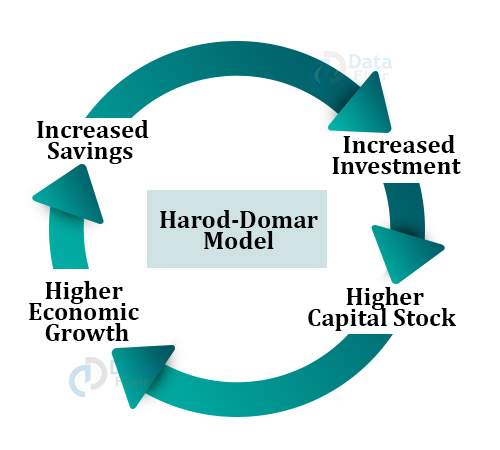

The circle that the model observes is in the figure below –

Diagrammatic Representation of the Model

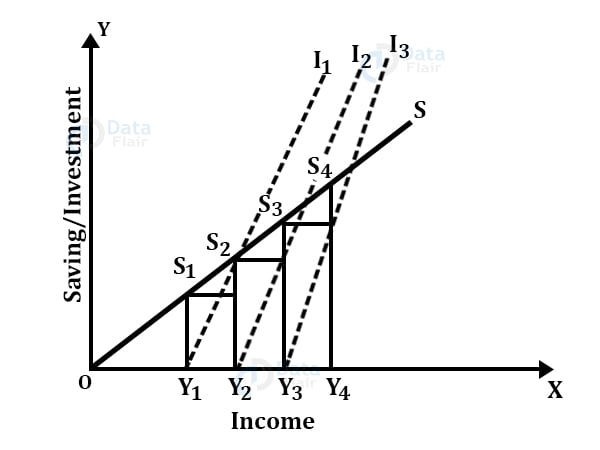

The X-axis represents the income and Y-axis represents the savings and investment. SS is the savings line and it represents that different levels of income correspond to Y different levels of saving. Slopes of Y1I1, Y2I2 lines indicate the capital-output ratio.

By investing in the savings, income would rise by Y1Y2. At the OY2 level of income, the savings would shift to Y2 S2. This will stimulate investment and income. Income would now by OY2 and the process will continue repetitively.

Criticism of the Harrod Domar Model

Critics believe that Developing countries find it difficult to increase saving. The model further, ignores the factors like labor productivity, technological changes, and the levels of corruption.

The model assumes the existence of a reliable finance and transport system, which is not feasible for developing countries to arrange. The critics also say that it is arduous for developing to increase the savings ratio because of the widespread poverty.

Lewis Model of Development with Surplus Labor

This model of economic development was introduced by Lewis in the year 1954. The model divides the economy of an underdeveloped country into two sectors namely, the Subsistence sector and the capitalist sector.

Subsistence is recognized with the agricultural sector of the economy and the capitalist sector signifies mainly, the manufacturing sector of the economy. The subsistence sector is considered to be labor-intensive and the capitalist sector can be either private or public.

Assumptions of the Lewis Model of Development

a. Surplus labor in the subsistence sector

The model assumes that there exists surplus labor in the subsistence sectors. This labor comprises farmers, petty traders, domestic servants, agricultural laborers, and women. Lewis believes that the supply of labor is perfectly elastic at particular wages.

b. Importance of saving

Lewis assumes that the capitalist sector and the subsistence sector generate savings. He was fascinated by the higher propensity to save the capitalist sector.

Working of the Lewis Model

The working of the Lewis model is quite simple. Lewis believes that a wage higher than the institutional wage prevailing in the subsistence sector by a specific proportion of the institutional wage is fixed in the capitalist sector.

With this, the capitalist sector will be able to attract an immense quantity, the labor from the subsistence sector. It will enable the capitalist sector to expand. Which will, in turn, lead to a generation of more savings in the capitalist’s sector.

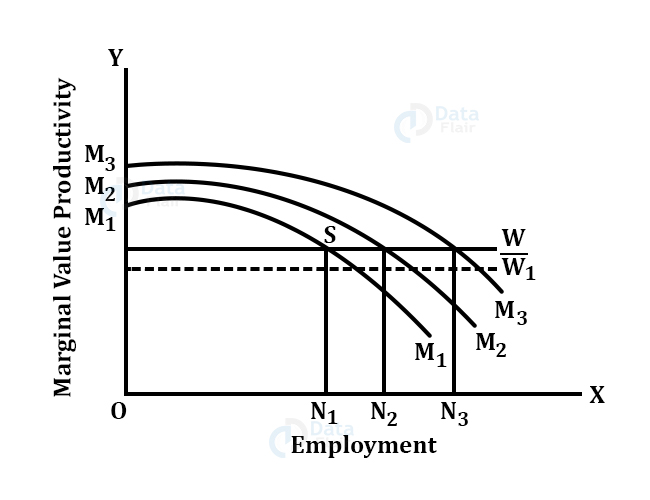

The wage in the capitalist sector should be higher than the instructional wage because only a higher wage can attract labor from the subsistence sector. Initially, employed labor is ON-I. It will lead to the generation of surplus that equals the AMIS after the payment of wages at the rate W.

Lewis believed that this surplus AMIS will be reinvested either in the old type of capital or might be used to improve the existing techniques. This will result in the marginal productivity curve of labor moving to M2. At this wage, the amount of labor employed is ON2. This will repeat at each stage.

He was also conscious of the fact that the creation of bank credit will give rise to the inflationary increase in prices. However, he was not much perturbed by this prospect and believed that inflationary pressures will not continue forever.

Critique of the Lewis Model of Development

The assumption of disguised unemployment in the agricultural sector was not well taken by economists. Critics also believe that he ignored the cost involved in training the unskilled worker transferred from the subsistence sector.

Besides labor, the model assumes an unlimited supply of entrepreneurs in the capitalist sector. It is also not ethical to assume that the landlords always squander away their savings. As assumed by Lewis, inflation is not liquidating.

The model assumes there is an unlimited supply of entrepreneurs in the capitalist sector, which is not true in the case of the underdeveloped countries.

Balanced and Unbalanced Growth

Balanced Growth

It is an equilibrium in which major aggregates, usually but not exclusively, are the capital and the output stock, grow at the equivalent rate over time, and the real interest rate remains the same. It aims at harmony, consistency, and equilibrium in an economy.

It suggests that economic growth is sustainable in the long-term. And the economy is also developing across different sectors as it is not focused on one particular industry or area.

Some of the features of balanced growth involve low inflation, trade balance, the balance between savings and consumption, the stable housing market, equal distribution, sustainable levels of debt, sustainable bank lending, and more.

Unbalanced Growth

Unlike popular opinion, it is important to understand that unbalanced growth is not harmful but a necessary part of the economic development. Hirschman argued that unbalanced growth and the dynamic tensions that it creates helps to speed up economic development.

Also, if there is growth in one sector, there will be a multiplier effect, which will cause the induced investment in related industries. In case, the mining industry develops and creates more infrastructure, this will later benefit different industries that can make use of the same infrastructure.

Human Capitals and Economic Growth

Human Capital and economic growth are deeply related to each other. Higher human capital can lead to a higher and better economic growth. Economic growth is measured by evaluating the Gross Domestic Product of a country.

Some governments are actively committed to improving human capital by offering higher education to people at zero cost. They realize that the knowledge that people gain through education helps develop an economy and boost economic growth.

Companies also tend to invest in human capital to boost profits and productivity. The company might offer to pay for a portion of the tuition for their higher education.

Also, Investing in workers has a track record of creating better employment conditions in the economies throughout the world. An improvement in employment leads to a rise in consumer spending which further induces an increased revenue for the companies and additional business investment.

This makes employment a key indicator for determining the growth of GDP.

Research and Development and Economic Growth

Investment in Research & Development is one of the key strategies to secure technological potential, and thereby innovation and economic growth.

Research and development comprise creative work that is undertaken on a systematic basis, to increase the stock of knowledge, including knowledge of man, culture, and society, and the use of this stock of knowledge to devise new applications.

The investment increases the possibility of achieving a higher standard of technology in the firms and regions. This will allow them to introduce new and superior products and processes which will result in higher levels of income and growth.

The need to prioritize innovation and research and development is now stronger as the competition between the countries mounts and the global growth slows.

Conclusion

The economic growth of a country is guarded by not one but many factors. These factors include Research and Development, Human Capital, and more. There are two types of growth, balanced and unbalanced growth.

However, some people feel that unbalanced growth is not healthy for the economy. It is important to acknowledge that unbalanced growth has its own positive and escalating effects on the economy of a country.

Your opinion matters

Please write your valuable feedback about DataFlair on Google