Blockchain Mortgage – How Blockchain Transforms Ecosystem

FREE Online Courses: Click, Learn, Succeed, Start Now!

Blockchain mortgage value chain currently faces a lot of fragmentation due to the involvement of numerous intermediaries. It is fundamentally paper-based and manual which makes it more prone to errors than other industries that have adapted well to the digital revolution.

Blockchain technology might have the perfect solution to transform the mortgage industry. There could be a considerable reduction in costs, due to reduction in the paperwork and intermediaries involved. There could also be increased customer satisfaction and retention due to a smoother process.

Being a decentralised, contract based transparent transaction management system blockchain offers a uniquely powerful way to link mortgage origination, initiation and execution. It can reduce costs, fees, fraud, time and improve efficiency, certainty, reliance and transparency.

First let us try and understand the existing mortgage process

Traditional Mortgage Process

While there are a number of other contributing factors, the time to receive a mortgage using the existing method ranges from 30 to 60 days. Let us review the diligent application process and the steps involved in this process.

1. Prequalification: Mortgage lender offers a price quote depending on the credit score.

2. Application: The home buyer then completes the application required to be submitted to the government agencies. It includes their employment history, income, assets and other relevant information a lender would need to approve or deny your application.

3. Processing: Loan processing or verification of all the information on the application includes appraising the home to confirm its worth.

4. Underwriting: An underwriter reviews all the information and finally decides to approve or deny the loan. Specifically, the underwriter checks the amount of risk involved and determines if a person is potentially a risky borrower.

5. Settlement: If the underwriter approves the mortgage, the final step is settlement or closing. After the settlement, the mortgage finalises, and the buyer can move into their new home.

Working of Blockchain Mortgage

Let us try understanding a Blockchain mortgage using an example.

A person wants to buy a home and is already pre-qualified for it. They will complete the application, which will become a block on the blockchain. Every party involved in the process will have access to the block. This will allow them to easily and quickly verify the information.

If and when the loan is approved, the buyer will receive an encrypted key in order to sign the offer Their signature will be recorded as a new block to the chain. Then the funds will be transferred on the blockchain as well, and hence become a block on the chain. This entire process will take mere days, instead of a month.

After the mortgage is approved, mortgage servicers can use blockchain to track payments from the borrowers. Furthermore, any refinancing or selling of the property can be managed easily as blockchain can be used to verify property ownership.

How is Blockchain Being Used Today?

1. Lending: Several lending finance institutions are experimenting with blockchain technology to improve the efficiency of the mortgage lending and closing processes. It is used to record, share, and exchange data about the loan. With a loan file stored on blockchain, institutions can now leverage blockchain as the custodian. They can also perform validation checks on the loan file and store outputs of those checks to ensure transparency. Blockchain adds a greater level of security by providing a record of the loan file that cannot be tampered with or lost.

2. Title and closing: Several title insurance companies have adopted blockchain technology to facilitate the exchange of prior insurance policies and support remote online notarization. This helps to improve efficiency and reduce the risk. The transparent decentralised database reduces the risk of data manipulation.

3. Mortgage-backed securities (MBS) training: There are several companies today that trade cryptocurrencies, equities, and securities on blockchain. Primarily because this is a method to increase liquidity and cut settlement times. It also helps to reduce risk and expenses. Blockchain is being used for securities trading to record the trades and verify underlying collateral on the shared digital ledger. This improves transparency, speed of settlement, and reduces risk.

Areas Primed for Disruption through Blockchain

1. Mortgage Closing

- Mortgage closings today take about 30-90 days for contingencies such as financing, appraisals, and securing title. Closings have also been in-person, involving a lot of documents and multiple re-verification steps, needing time and expense to the process. Steps included :

- Document Verification: Increasing numbers of lenders will conduct validation checks and certify information with blockchain.All privileged entities are then made aware of the information securely, reliably, and instantaneously.

- Title Transfer: Title companies will increasingly use blockchain technology to identify and validate titles. By doing this, accuracy and efficiency will be improved, and title insurance may be eliminated entirely.

- Notarization: The next generation of e-notarization and e-mortgages will use blockchain to ensure information accuracy, while preventing tampering and fraud.

2. Mortgage Servicing

Blockchains and DLTs can save a lot of time and money for mortgage servicing. It can also reduce the operational burden of meeting regulatory requirements. This is by eliminating document tracking and information reconciliation, and digitising payments.

- Smart Contracts: By the use of smart contracts, with embedded Al and security, blockchain can digitise and automate the entire loan application process.

- Payments: Blockchain allows digital payments that could be exchanged across the platform in a synchronised fashion without intervention.

- Regulatory Compliance: Compliance with regulatory standards is constantly monitored by service providers, who are required to provide proof of proper servicing procedures. Blockchain’s immutable record eliminates manual errors, increases regulatory audit efficiency, and reduces regulatory violations.

- Mortgage Servicing Rights: By using blockchain technology to allow for greater transferability of Mortgage Servicing Rights, you could see greater liquidity in this market.

3. MBS Settlement

Blockchain can challenge the long standing control exerted by Some organisations over the MBS clearing and settlement process. Blockchain technology continues to prove its ability to provide safety and soundness in this market and allows the market to grow.

- Speed: Blockchain could execute settlement in hours rather than days, thereby reducing the transaction expenses and margin volatility exposure.

- Posting Collateral: By reducing the transaction time, blockchain can effectively remove the need to post margin to protect against the risk of a trade collapsing

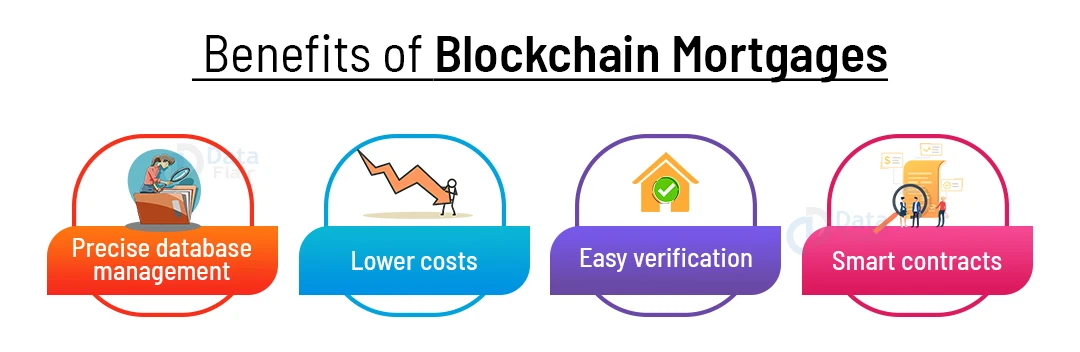

Benefits of Blockchain Mortgages

1. Precise database management: Traditional mortgage methods involve a lot of paperwork. Buyers need to verify income, assets and employment history. Blockchain collects all the necessary documents and information into digitised records, which are easily accessible.

2. Lower costs: Blockchain technology eliminates intermediaries during the settlement process, which will help reduce closing costs.

3. Easy verification: Usually, to protect themselves against liens on the property, buyers need to buy title insurance. Title insurance can be eliminated due to the ease of verifying the chain of title thanks to blockchain.

4. Smart contracts: Smart contracts are coded sets of rules that trigger when a specific event occurs. For example, if a buyer purchases homeowner’s insurance, the mortgage can move to the next step in the process automatically.

Legal Issues Concerning Blockchain

Blockchain technology is a revolutionary but relatively novice innovation. This is a reason why a lot of effort is being given into researching the pros and cons of it. Mortgage processing is a rather important field that must be handled with care and utmost importance. Thus, there are some concerns and potential issues that must be tackled before revamping the existing system.

Blockchain is largely an unregulated technology. It also offers no defined standard method to process mortgages. NOw this might sound exciting to a few, one could argue that this lacks the strength to address some major issues.

Added to this, while very secure, blockchain is not 100% impermeable. Granted, it is safer than our existing methods, but there is also denying that savvy hackers have broken into blockchain security protocols as well.

Also, for blockchain to work properly and effectively, everyone involved in the process has to be on board. If the buyer and the seller cannot agree upon the blockchain without the lender.

Actions to Consider

Several areas are ripe for disruption through the implementation of blockchain technology in the mortgage industry. The property ownership and mortgage finance industries will be transformed rapidly by blockchain, distributed ledgers, and smart contracts. Consequently, it may be a good idea to assess how these technologies will impact your organisation and how to exploit emerging solutions to benefit your company, stakeholders, employees, and customers.

Property Records in Blockchain Mortgage

Property records can be stored on a blockchain, and therefore anyone can access the public ledger to track the owner. Anyone can also read liens against the property in written account order. For instance, few lenders can finance a property with an associate existing lien. As a result, if the house finally ends up in a very proceedings sale, the lien pays off first. Providing enough funds for the Blockchain mortgage investor to repay.

How Can Blockchain Transform the Ecosystem?

Blockchain can transform the ecosystem in two major ways :

1. Automating MI certifications and pricing via smart contracts

PMIs use smart contracts thus when every party must agree with the loan specifics, insurance type, and supreme premium rating. For instance, each party would possibly conform to the loan’s LTV, FICO score, loan quantity, loan type, and premium sort (month, semi-annual, single premium, etc.).

This ultimately drives the following MI rating in agreement by each party, even as it will nowadays, however a blockchain system may permit all parties to certify and conform to conditions in a very clear and verifiable manner.

2. Tracking the MI certificate and claim filing

Once the loan insures, associate degree MI certificate allots by associate degree MI merchant. To extend transparency, that certificate can hash inside a blockchain and everyone parties may track the performance of recent insurance written (NIW). If a recipient fails to repay the mortgage, blockchain would track the loan’s delinquency, default, and later proceed.

Conclusion

In this article, we familiarised ourselves with the concept of Blockchain Mortgage. While it’s a rather new idea, it does seem to offer a lot of solutions and benefits. After reviewing the faults and issues with the existing mortgage system, we discussed how a blockchain based system might help. We also learnt the benefits of the system, and then discussed the legal issues that might discourage the process.

Your 15 seconds will encourage us to work even harder

Please share your happy experience on Google

thanks for sharing the information with us about blockchain Mortgage . good post